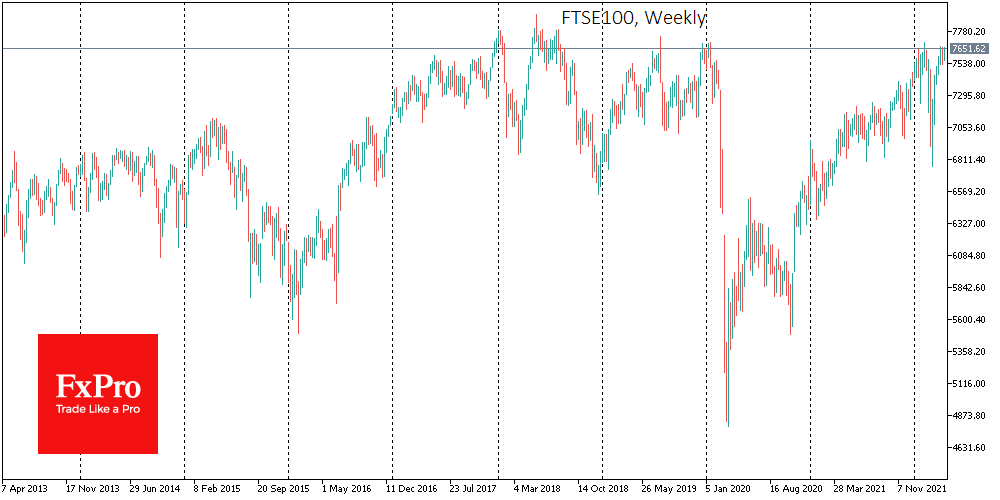

The UK stock market is closer5 to a full recovery from the recent slump than its counterparts in the US or continental Europe. The FTSE100 at 7640 is now only 0.7% below its peak in February. By comparison, S&P500 at 4500 is 6.6% below its record level, while EuroStoxx50 is now 10.5% below its peak in November 2021.

The more confident rise of the British stock market is due to the heavyweight of overseas mining companies on the back of the commodity price boom and the recovery of the banking sector.

However, the FTSE100 runs the risk of being in a turbulence zone at this altitude. Since 2018, the index has reversed to a sharp decline in the 7700-7800 area, never managing to consolidate above. This time, a consolidation above the 7,800 area could attract massive buyer demand, confirming the overcoming of the curse of this height.

On the other hand, the bears have enough reasons to increase the pressure from these levels, from the loss of growth momentum by the economy to the need for leading central banks to tighten monetary policy.

The latter factor represents the most significant risk, as stock market successes and the pound’s weakness could be essential proxies for more aggressive monetary policy.

The FxPro Analyst Team