Politics is once again temporarily becoming the main driver for the single currency. EURUSD returned to 1.0925 on Monday, gaining 0.8% from Friday’s lows on reports that incumbent Macron is ahead of far-right Le Pen and will potentially get even more votes in the second round on April 24th as the majority of those voting for alternative candidates lean towards Macron.

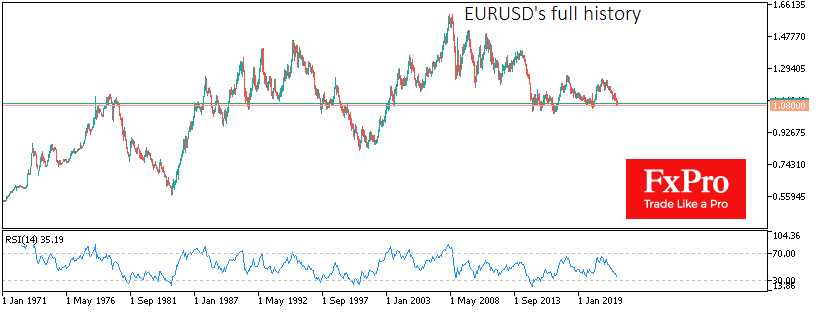

The lowering of political risks is attracting buyers of the single currency as EURUSD fell late last week to 1.0850 – near the lows of March and a support area in the pair between February and May 2020.

In 1997, the EURUSD (then still non-cash) was gaining support near this level, but a return to 1.08 two years later triggered a capitulation. The EURUSD sell-off then had only halted two years later after the single currency had lost a quarter of its value and only after ECB interventions.

The French elections and the events in Ukraine have enough potential to trigger a historic euro move away from that line.

A strong pullback under 1.0800 opens the direct road to 1.05 (pandemic lows), but it may only be the first step in a long-term slide of the single currency towards 0.8500.

The opposite is also true: the political détente in the coming weeks may fundamentally change the attitude towards the single currency, making purchases attractive in the long term from the current levels.

Investors and traders should pay close attention to the EURUSD in the coming weeks because the following dynamics will be decisive for the number one currency and the entire forex market for many months.

The FxPro Analyst Team