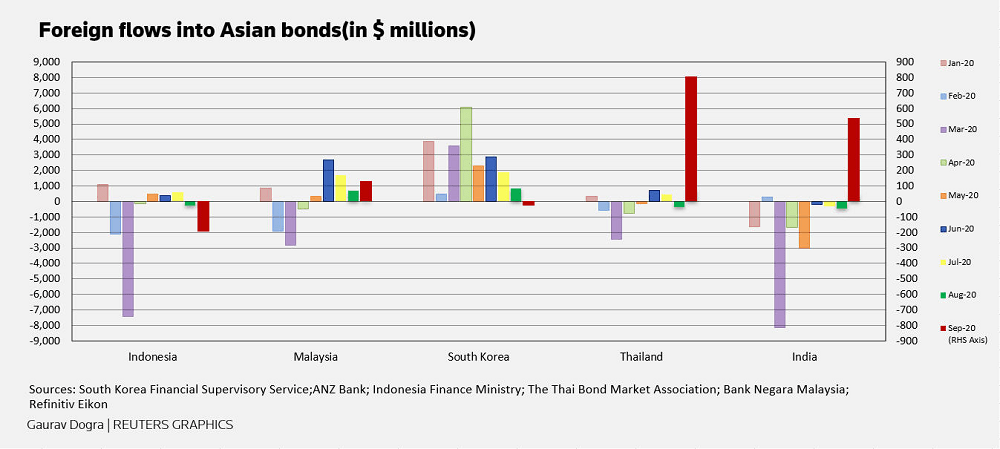

Foreign investors poured over $1 billion into Asian government and corporate bonds in September, more than doubling their investment in local currency debt from the previous month, attracted by higher yields and some signs of economic recovery. Asian local currency bonds received a combined total inflow of $1.26 billion last month, data from regional central banks and bond market associations in Indonesia, Malaysia, Thailand, South Korea and India showed. That was down from $2.13 billion in September 2019 but up from $489 million in August.

Asian countries have had mixed success in containing the coronavirus outbreak and protecting their economies, but foreigners became net sellers of Asian equities in September on concerns about a virus resurgence, prompting them to sell $6.5 billion worth of regional equities. Bonds markets in places such as Thailand and India could therefore be benefiting from a portfolio rebalancing, analysts said.

Foreigners purchased $807 million worth of Thai bonds last month, the highest in over a year, according to Thai bond market association data. Foreign investors meanwhile poured $538 million into Indian bonds in September, the first inflow in seven months. Malaysian bonds also received $132 million worth of foreign capital last month, but foreign investors sold Indonesian bonds on concerns over rising coronavirus infections.

Foreign inflows into Asian bonds more than doubles in September, Reuters, Oct 19