As most had predicted, the Federal Reserve raised the rate yesterday by 75 points to 3.00-3.25%. However, all participants’ attention was drawn to the accompanying comments and forecasts, a change that underpinned the latest market movements and may explain its dynamics in the coming days.

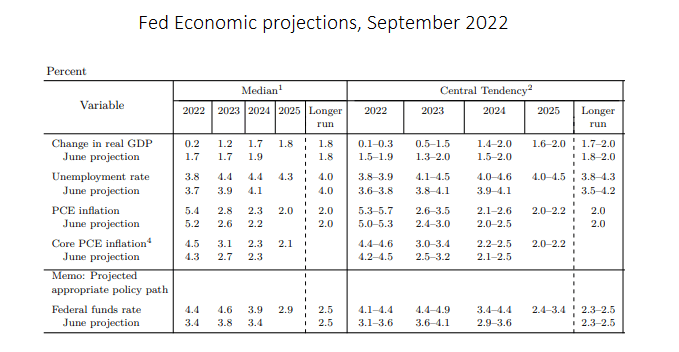

The outlook for the economy has darkened considerably, with GDP forecasted to rise by a flimsy 0.2% in 2022 against June’s projection of 1.7%. Unemployment is expected to grow from 3.7% now to 4.4% next year. Both of these forecasts point to a reversal of the economic cycle to a downturn.

Perhaps most sensitive to the markets was the change in key rate expectations. For the end of this year, the Fed plans to raise the rate to 4.4% from 3.4% three months earlier. At the end of next year, the rate is projected at 4.6% versus 3.8% in June.

This outlook sets the markets up for another 75-point increase in November and another +50 points in December. The current Fed Funds Rate level is the highest since the beginning of 2008, breaking a trend of declining peaks over the last 40 years.

A significant shift for markets is also Powell’s comments calling for a recession to be seen as a price stability payment. This is a very bearish signal for markets that they may have to endure more pain, and the recent sell-off in equity and bond markets has not shaken confidence in their chosen path.

This potentially means more pressure on markets in the coming days and more demand for the dollar as a higher-yielding currency.

The FxPro Analyst Team