More than one-third of large institutional investors hold crypto assets, and the most popular one is bitcoin, a recent survey showed. As many as 36% of institutional investors in the US and Europe own crypto assets, according to a survey of 774 firms released Tuesday by Fidelity Investments. Institutional investors include pension funds, family offices, financial advisers, and hedge funds.

In the US, 27% of investors said they hold crypto assets, up from 22% a year ago when Fidelity surveyed 441 American firms. In Europe, 45% of firms surveyed said they hold crypto assets.

Of the digital assets held, bitcoin is by and far the most popular, according to the survey – more than 25% of respondents said they hold bitcoin, and 11% hold etherium.

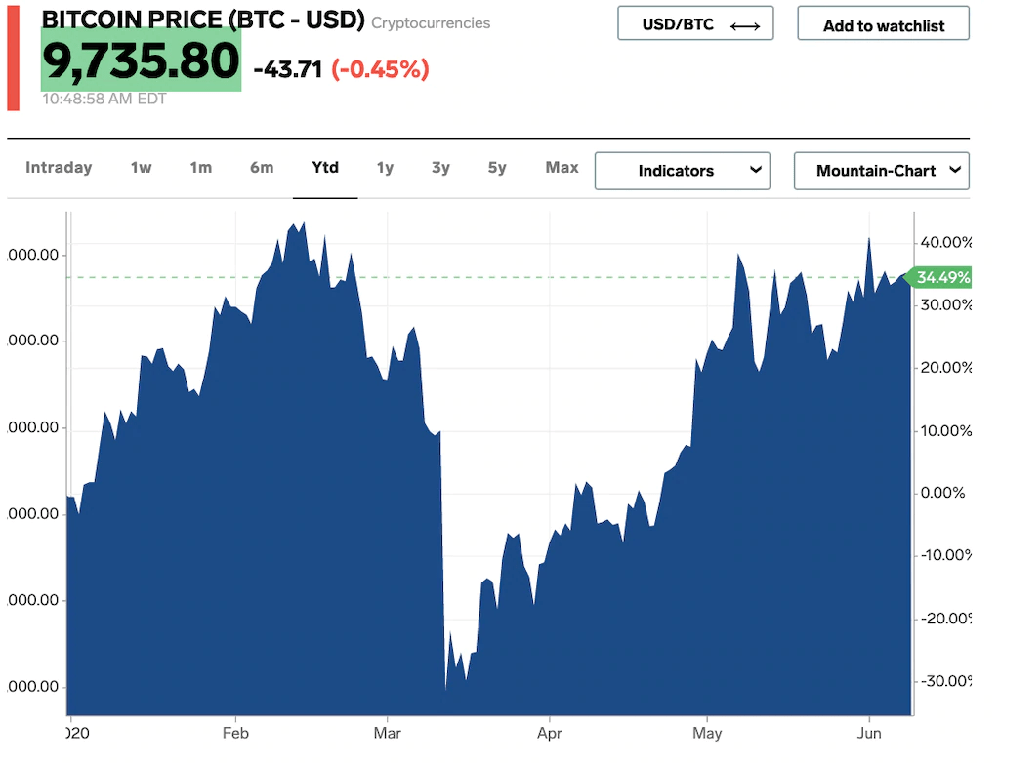

Bitcoin has been on a tear this year as markets whipsawed amid the coronavirus pandemic and reopening efforts. The digital currency has gained 36% for the year after tumbling in early March and swiftly recovering.

Fidelity’s survey found that the biggest obstacles cited by firms still hesitant to dive into crypto were price volatility and concerns about market manipulation.

The survey was executed by Greenwich Associates between November and March, right before the crypto market sank and recovered.

As many as 36% of large investors own crypto assets, and bitcoin is the most popular, Fidelity says, Businessinsider, Jun 10