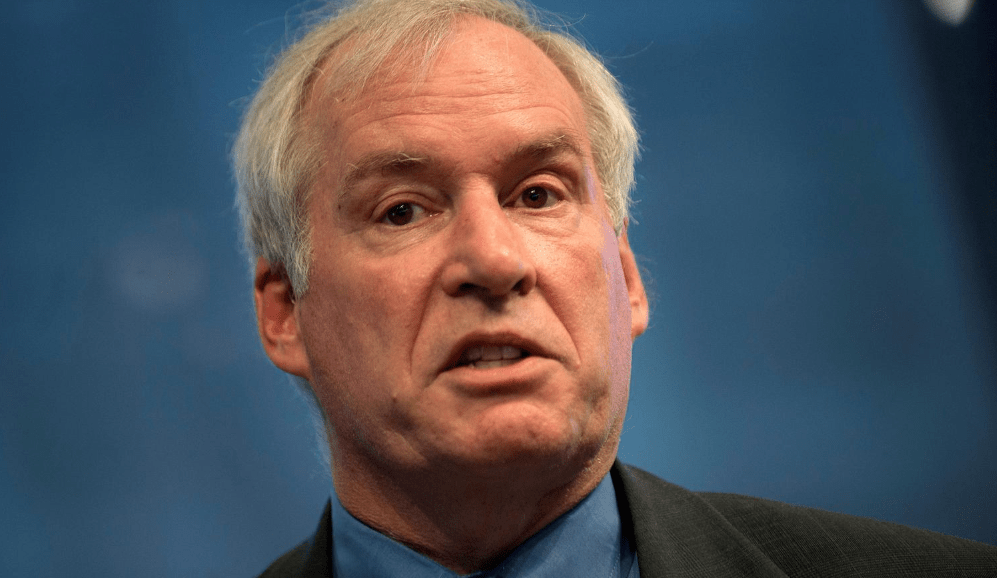

Businesses will face weak demand as long as consumers and workers are worried about public health, and the unemployment rate is likely to stay in the double digits at the end of the year, Boston Federal Reserve Bank President Eric Rosengren said Tuesday.

The unemployment rate could peak at close to 20% as more Americans lose jobs in the shutdowns put in place across the country to limit the spread of the coronavirus, and the losses could linger, Rosengren said in remarks prepared for a webinar hosted by the New England Council.

“Unfortunately, even by the end of the year, I expect the unemployment rate to remain at double-digit levels,” he said. Policymakers will take action to help reduce the length of time that people are out of work and some of the Fed’s emergency lending facilities helped to ease the pressure in short-term funding markets, Rosengren said.

The Main Street Lending Facility, which aims to make credit available to small and medium sized businesses, should launch by the end of the month, Fed Chair Jerome Powell said on Tuesday.

Businesses that meet the requirements will be able to turn to their lenders for a loan, Rosengren said. However, the program will not help all businesses in need, he cautioned.

“It will not be able to assist everyone, but we expect that it will provide an important bridge for many businesses that employ much of the American workforce,” Rosengren said.

Fed’s Rosengren says U.S. unemployment rate could remain at double-digit levels by end of year, Reuters, May 19