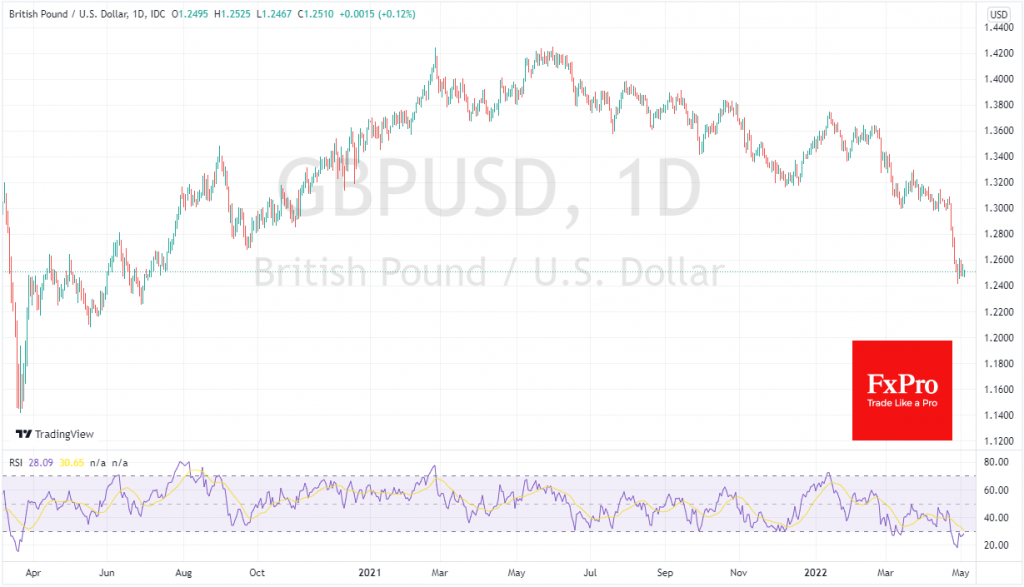

GBPUSD is hovering around 1.2500 for the sixth consecutive trading session. But this stabilisation is more like the calm before the storm than a new balance point.

The Pound enjoys a fragile equilibrium as investors and traders choose to take a wait-and-see approach ahead of the super week when the Fed (later today) and Bank of England (Thursday) decisions will be released, as well as the US monthly employment report (Friday).

These three events have enough potential to trigger the Pound’s most substantial volatility in weeks, capable of also reversing the decline in mid-April.

On the technical analysis side, GBPUSD, which started April above 1.3100, is highly oversold, typically creating the potential for a rebound to 1.2660 or further to 1.2880.

However, such a fragile technical picture could be disrupted by news if the market reaction to it proves to be one-sided. In case of a tough Fed stance and a relatively toothless Bank of England stance on Thursday, a rather fast track to 1.2000 opens for GBPUSD, where the pair could end up before the summer.

Although the GBPUSD went briefly lower in March 2020, it has not been consistently lower since 1985, having spent less than six months below that line.

The FxPro Analyst Team