The Fed gave an unpleasant, albeit mild, surprise to the markets for the second time in a week (after the FOMC statement) by announcing that it will not extend the relief for treasury dealers introduced in the pandemic’s early months to support the markets.

Dealers have reduced treasuries’ holdings on their balances in recent weeks, which has added pressure to debt markets and pulled up yields. There were hopes that the pressure on the markets would force the Fed to extend the crisis-era rules by easing the debt markets’ anxiety, but this did not happen.

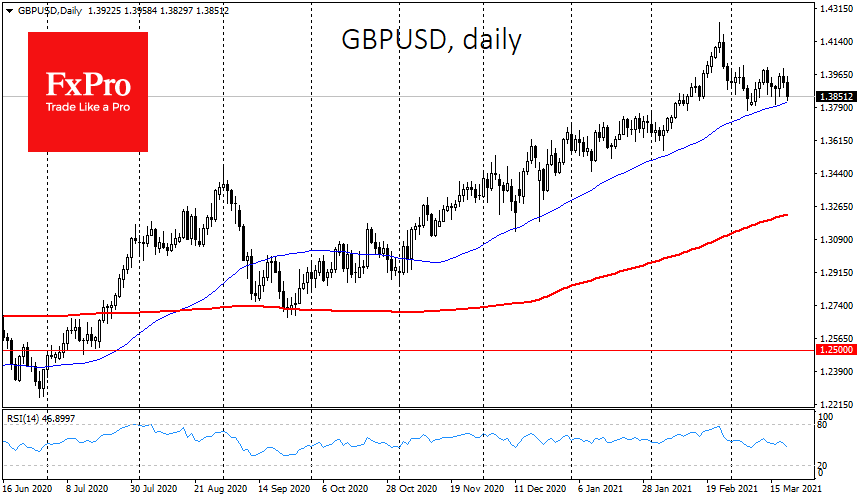

Following bonds, selling pressure is spreading to the equity market and risk assets in general. In FX, this trend is causing a pull into the dollar, which added 0.4% and 0.8% against the euro and the pound.

As the Fed is showing little sign of concern and is not looking to impact, this may favourable in the short term.

The EURUSD and GBPUSD declines could increase as they fall below short-term support levels at 1.1840 and 1.3800, respectively.

The FxPro Analyst Team