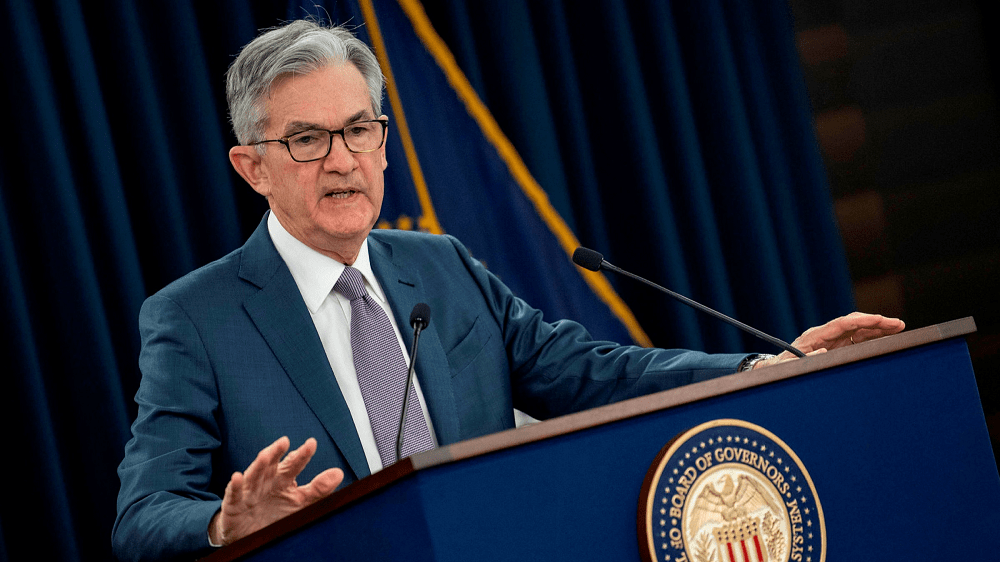

The Federal Reserve left interest rates near zero and vowed to use all its tools to support the recovery from an economic downturn that Chair Jerome Powell called the most severe “in our lifetime.” “The path forward for the economy is extraordinarily uncertain, and will depend in large part on our success in keeping the virus in check,” he told reporters in a virtual press conference Wednesday after the Fed left interest rates near zero. He sounded a dour tone about how long a road is ahead to get back to where the country was only months ago and noted that more fallout from the virus still lies ahead.

Powell said that not all sectors of the economy were weakening, citing the housing sector as one bright spot. But on balance it looks like the data “are pointing to a slowing in the pace of the recovery,” he said, though it was too soon to say how large — or sustained — this pause would last.

“I think many FOMC members were discouraged by the resurgence in Covid-19 across much of the Sun Belt this summer and the subsequent pullback in economic activity,” said Mark Vitner, senior economist at Wells Fargo & Co. “This summer’s resurgence in Covid-19 showed how vulnerable the economy is and how difficult it is to make economic policy when we do not know what the virus will do next.”

High-frequency economic indicators are pointing to a stall in the rebound as consumers hold back from activities like dining out and air travel, which had started to bounce back when the earlier wave of outbreaks dissipated.

The vote, to leave the federal funds target rate in a range of 0% to 0.25%, was unanimous. The FOMC also reiterated its pledge to increase its holdings of Treasuries and mortgage-backed securities “at least at the current pace” over coming months.

Powell and his FOMC colleagues have kept their benchmark rate pinned near zero since the pandemic’s onset in March and rolled out several emergency lending programs geared toward fostering liquid trading conditions in financial markets. That aggressive action has helped to calm investors. But progress toward recovery has been complicated in recent weeks by a new wave of coronavirus outbreaks across major states in the South and West including Texas, Florida, California and Arizona.

Investors have remained relatively optimistic despite renewed signs of weakness in the economy, thanks in large part to rising hopes that researchers will soon succeed in developing a vaccine.

Before Wednesday’s decision, the S&P 500 index of U.S. stocks was within about 4% of the record high set in mid-February after losing more than a third of its value in the early days of the pandemic.

Fed Sticks to Whatever It Takes With No Sign of Virus Easing, Bloomberg, Jul 30