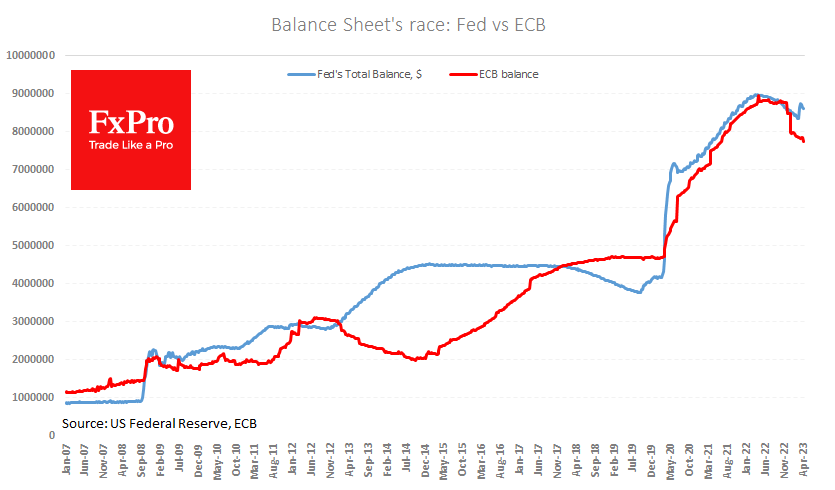

The Fed’s balance sheet shrank by 17.6 bn last week to 8,615 bn. Down 119bn over three weeks, the balance sheet is still 275bn higher than at the start of March.

Pumping liquidity into the financial system helps to support demand for risky assets, as it reduces stress in the financial system and creates more optimistic expectations for the banking sector and the market.

A shrinking balance sheet is only good news for the dollar in theory. In practice, the ECB is more disciplined in reducing its balance sheet. Moreover, comments from European officials are shaping expectations that the next ECB rate hike will also be a 50bp hike. Markets are currently pricing in a 69% probability of the Fed’s 25bp hike and a 31% probability of no hike.

The situation with US banks in March highlighted the Fed’s flexibility and willingness to change course as circumstances dictate. This is good news for the economy, commodities, and equity markets but also a negative agenda for the dollar. The US is clearly in the lead regarding policy tightening, while the ECB is raising interest rates and selling assets from its balance sheet more actively.

We expect this to continue, putting moderate pressure on the USD against its major rivals. On the macro monetary policy, 2022 is similar to 2002, when the EURUSD began a strong recovery, and the pair rose by more than 50% in less than three years.

The FxPro Analyst Team