The rate decision and the Fed’s comments promise to be the highlight in a week full of releases. The market is in no doubt that the pause in policy tightening is here to stay, with interest rate futures pricing in a near 100% probability of a hike. Comments from Fed officials in recent weeks have removed all intrigue, showing a consensus for keeping policy on hold to gather more data.

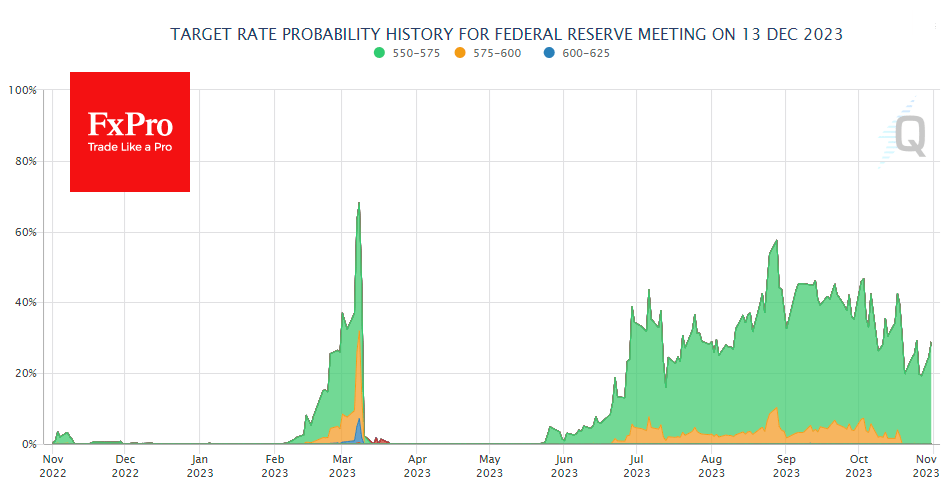

All the intrigue and potential for market movement is focused on sentiment about the path forward. According to the latest data, markets are pricing in a 27% probability of a December hike, which was as low as 20% recently.

Meanwhile, the US economy continues to churn out much stronger-than-expected numbers and gain momentum. Just look at the GDP growth rate of almost 4.9% in the last quarter; before the pandemic, we last saw this in 2014. What a stark contrast to expectations of a recession!

In such an environment, Fed chief Jerome Powell has little choice but to continue threatening the markets with a willingness to raise interest rates even further if inflation picks up. And these potential threats, it seems to me, should be open enough to reach markets that do not believe in further hikes and are pricing in a first cut as early as next summer.

These are perfectly reasonable predictions, but they require a sharp cooling soon to materialise. And that requires scaring the markets beyond belief. If Powell can convince the markets at the press conference that he is not bluffing when he threatens another hike, that will be the best news for the dollar.

The US dollar was in a slow but steady rally until early October. The dollar index paused while awaiting critical economic data and central bank decisions. This situation paved the way for movement in both directions.

Therefore, in the event of a real threat of a rate hike, the US dollar rally may get a second wind, and we will see both the initial strong momentum and the subsequent smooth rise on the renewed carry trade.

Tighter monetary policy will also be good news for the US bond market, in our view. It has recently suffered from falling bond prices (rising yields) for long-term bonds. However, raising short-term rates will increase the odds of an economic slowdown by lowering long-term rates, which means higher bond prices. And that’s what the Fed and the Treasury need right now.

The main question, in our view, is whether Powell will be able to convince the Fed that his threats are serious (if they are, of course), given that the credibility of the Fed chairman’s words has been undermined by his rhetoric being too hawkish in 2018 and too soft in 2021. In the former case, he promised more rate hikes when the market was already signalling that it was coming apart at the seams.

The collapse in equities and the turmoil in the interbank lending market forced a change of course. The more recent episode of “transitory inflation” is perhaps something everyone remembers. This is why the Fed now finds it challenging to manage market expectations and must do more than it could with greater credibility.

The FxPro Analyst Team