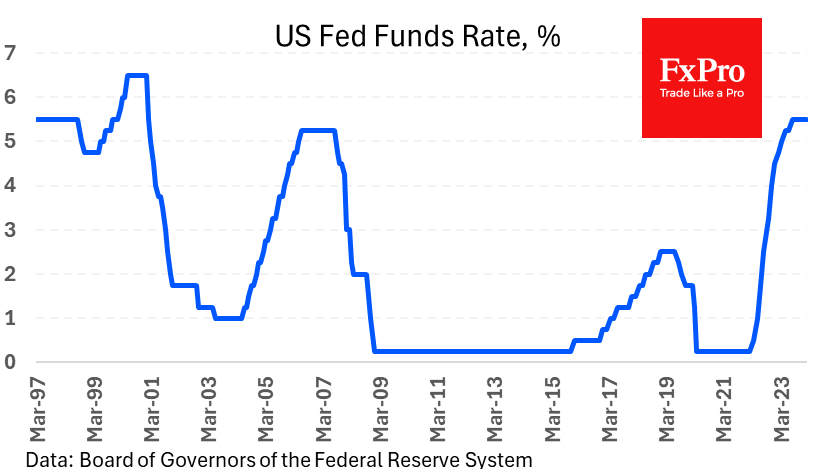

The US Federal Reserve left its key interest rate unchanged but altered its rhetoric, suggesting that the next step will be an easing of policy. At the same time, Powell went out of his way to tamp down expectations of an easing start in March. The dollar rose 0.8% on the news of the FOMC meeting, but this was barely enough to end Wednesday’s session higher, as it had fallen earlier in the day.

The Fed has been busy managing expectations in recent weeks, which has helped to reduce the odds of a March rate cut to 55% from a peak of 90% in late December. The previous day’s press conference pushed the odds down to 35%. Now, markets are confident that the starting point will be May.

During the press conference, Powell said that the committee wanted to see very credible evidence of a slowdown in inflation. The committee sees the possibility of normalising inflation without contracting the economy. However, Powell cautioned that if the labour market cools sharply, policy easing could be rapid.

The market’s reaction was apparent but not too sharp, as the press conference confirmed rather than set the trend that had already been established. An even more measured decline replaced Wednesday evening’s rally. As a result, the Dollar Index was never able to break away from its 200-day moving average, to which it has been glued for the past two weeks.

The chance to set the dollar’s trend now lies with the labour market, with another report due on Friday, but even this indecision is saying something. The trend of dollar weakness since the Fed’s November meeting has been clear, and the reaction to subsequent inflation reports or the December FOMC meeting has been solid.

We see the lack of momentum in the dollar’s favour as a demonstration of the strength of the sellers, suggesting a higher probability of a further move lower with a suitable news occasion. Perhaps the failure to go higher indicates a willingness to go lower.

The FxPro Analyst Team