On Wednesday, markets will be focused on US signals as fresh economic data and Fed comments can set the trend for the coming weeks or even months, with a direct impact on the fate of the dollar.

Prior to the start of the US session, retail sales data will be released with a growth forecast of 1.1% in August after +1.2% in July. Actual data being close to expectations may spur stock markets further, given that these are historically healthy levels. The expectations are almost four times higher than the average monthly figures for the last five years (+0.3%), due to the spending effects of the aid packages distributed earlier this year.

At the end of June, retail sales volumes exceeded the February levels. As we know, strong retail sales push inflation up. This often revives a feeling in the markets that the Fed’s policy is about to be tightened soon and supports the dollar. However, it may not be the case this time.

Later in the evening, the FOMC will be presenting its monetary policy commentary, which will focus on the labour market by looking over the threat of inflation. However, this focus on the economy, not inflation, can take real interest rates even deeper into negative territory, reducing the value of the dollar.

Without an expectation that the Fed will tighten its policy in response to inflation, a vicious spiral can be created in which high inflation causes an outflow of dollar assets, generating further price pressure. This is a frequent problem in emerging markets but is a long-forgotten one for developed countries. Naturally, in the case of the dollar, it makes no sense to expect the same unambiguous market reaction as in the case of the currencies of Turkey and Ukraine.

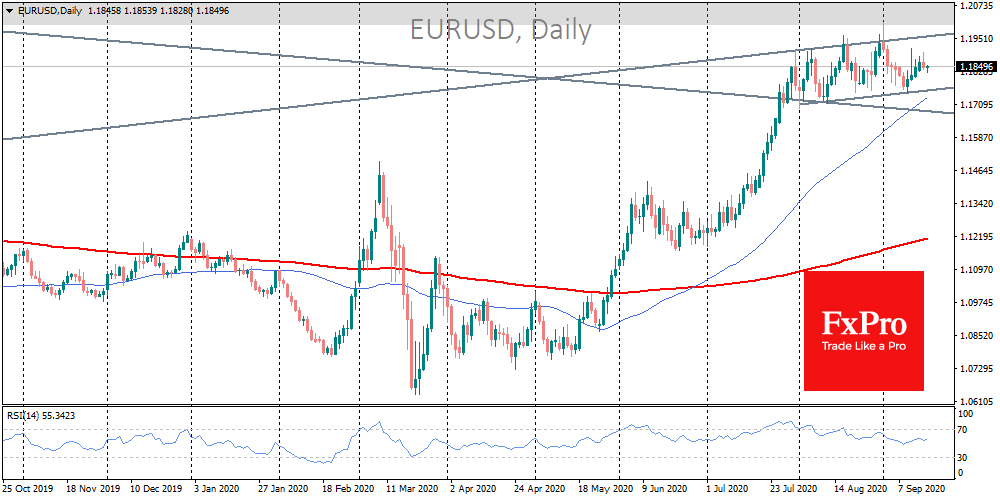

Suppose the Fed’s strategy change turns out to be as straightforward as Powell’s sounded last month. In that case, it may renew pressure to the dollar, and very quickly return it to the late August lows with the risk of EURUSD passing through 1.2000 this week, as well climbing above 1,2500 by the end of the year.

The FxPro Analyst Team