The Federal Reserve and other central banks will eventually discover that breaking up isn’t easy after partnering with their governments and the financial markets to avert a pandemic-driven depression. Investors and lawmakers enamored with cheap money may well balk when monetary authorities try to throttle back their quantitative easing and other stimulus measures.

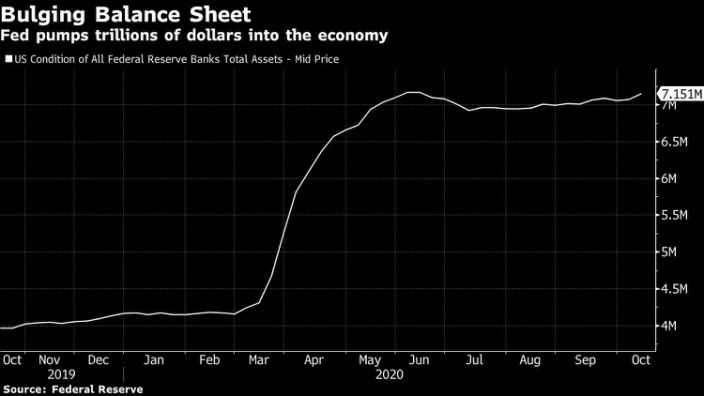

Instead, faced with slowing global growth and resurgent infections, the focus of policy makers at last week’s all-virtual International Monetary Fund and World Bank meetings was on more support for the world economy, not less. Central banks are pulling out the stops to do all they can, boosting financial markets with massive asset purchases and pushing government borrowing costs to record lows.

Fed Chairman Jerome Powell has repeatedly pressed for more aid to support to the economy until it’s clearly out of the woods. “The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side,” he told business economists on Oct. 6.

The trouble may start after a virus vaccine is approved and distributed and the U.S. and world economies begin to return to normal. If the Fed and other central banks are constrained from scaling back emergency stimulus at that point, the continued flood of liquidity could spur asset bubbles and even too-rapid inflation.

The Fed will also find it politically hard to trim its huge balance sheet after Congress effectively authorized an increase by allocating money to the Treasury to set up emergency lending facilities with the U.S. central bank, said Kroszner, now a University of Chicago professor.

The debt deluge may have other consequences. The Treasury market is now so large that that it may not be able to function smoothly on its own during times of stress, according to Fed Vice Chair for Supervision Randal Quarles.

Former Fed Chair Janet Yellen said she expects the Fed to provide more guidance on its plans for future asset purchases. But the aim of the buying would be to hold down interest rates, not fund the federal government.

Central bank leaders from Europe, Japan and the U.K. stressed the importance of maintaining the independence of their institutions at a virtual international banking seminar on Sunday.

The bond market is underestimating how strongly the U.S. economy will rebound, and that may lead to a “mini taper tantrum” next year, according to John Herrmann at MUFG Securities Americas. In the 2013 taper tantrum, yields surged after the Fed suggested it would begin scaling back its bond purchases.

El-Erian said that the U.S. central bank has “conditioned the market to such an extent that every time the Fed tries to step back, the market forces them back in” by selling off and tightening financial conditions.

Fed May Be Stuck with Forever Stimulus as Exit from QE Impeded, Bloomberg, Oct 21