U.S. statistics released on Wednesday signalled a decline in economic activity towards the end of the year, but the Fed maintained its hawkish rhetoric. Such a toxic mix turned markets lower towards the end of the day, causing the Dow Jones to fall 1.8% and the Nasdaq100 to drop 1.2%. The VIX fear index returned to above 20, a sign of a wave of selloffs in the equity market more than once during the previous year.

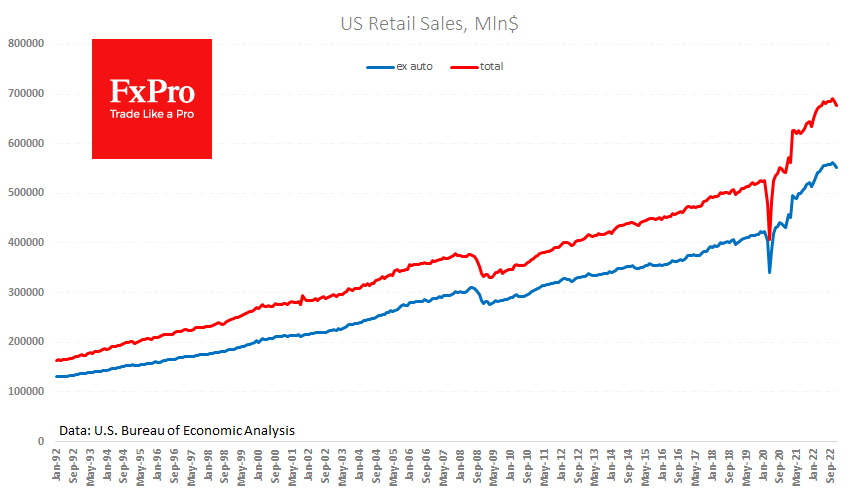

For December, retail sales fell by 1.1%, following a 1.0% decline a month earlier. Excluding cars, the drop was also 1.1%, more than double the 0.5% decline expected after a 0.6% decline in November. US retail sales at face value were released, adding 6.7% y/y, just 0.2 percentage points above the latest inflation figure. This is sharply below the 10-year average through February 2020, when lockdowns triggered sales turbulence, making such a comparison unrepresentative.

Like retail sales, industrial production recorded a second month of decline in December. Manufacturing lost 1.1% and 1.3%, respectively. The overall index of the industrial output lost 0.7% last month after declining 0.6% in November. On the chart, it reverses from above 102 for the fourth time since 2008. Whether we see a 15% pullback like in 2008/2009 or 2020 or a relatively shallow recession like in 2015-2016, this promises a difficult life for the stock market, which has moved in the same direction as manufacturing during the episodes in question.

Producers’ inflation was also weaker than forecast. For December, the overall index lost 0.5% (the most substantial decline since April 2020), and the annual rate fell to 6.2%. The core index, which excludes food and energy, slowed to 5.5%. The yearly comparison of producer prices has already hit a high base: In November 2021, prices started to rise sharply, and now we see a natural deceleration of the annual rate, although monthly declines are rare.

All the economic indicators listed indicate sharper-than-expected cooling of the economy. But at the same time, Fed spokespersons continued to assure that they would not cut rates before the end of the year as the markets expected. The divergence of opinion amongst the governing council is just what the next move will be. At least two now support an increase of another 50-points hike at the start of February, but markets see just a 5% chance of this move. The reassessment of these expectations could be a new driver for the market.

It is important to remember that in April and August last year, the Fed broke down overly dovish investor expectations and turned the index downwards. In recent weeks we have seen a particularly striking difference between the Fed’s stated stance and the expectations of market participants.

The Nasdaq100 index returned under the 200-week moving average, failing to stay above that line and reversing back down from the December 2021 downtrend line for the fifth time. Without an easing in the rhetoric of the monetary authorities by the February meeting, Nasdaq100 runs the risk of not only retesting the 10,600 area, from where it has been repeatedly ransomed since October, but also of updating, heading towards 10,000.

The FxPro Analyst Team