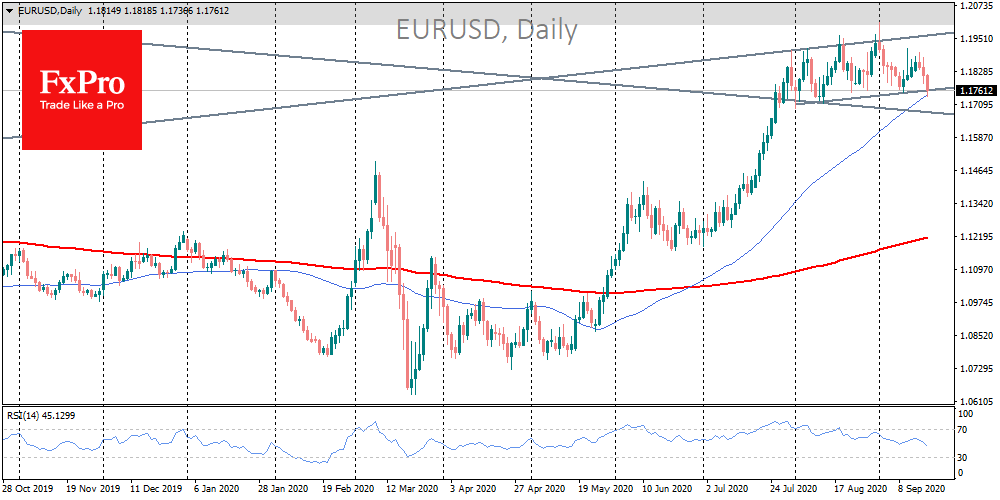

In the wake of the FOMC meeting last night, dollar purchases increased in the markets, and stock indices began to fall. EURUSD was briefly below 1.1740 at the start of trading today, a low for more than a month.

The S&P500 lost around 0.46% on Wednesday and futures on the index lost 1% more this morning. The S&P500 moved close to the 50-day moving average support where it bounced from last week. Nasdaq100 continues to test support at 11000. However, the bulls are still able to turn the market up from this area.

The world media states that frustration with the Fed is behind the growth of the dollar. Yesterday the regulator did not give any hints of new stimulus measures to be announced soon. Investors concluded from the comments that the Central Bank is satisfied with the recovery of the economy. Hence, their arsenal of stimulus is forecast to continue, with current QE and rates holding steady until 2023. At the same time, the FOMC forecasts note that inflation will not exceed 2% in the foreseeable future.

In our view, inflation forecasts are what is of interest to investors as they reflect a higher return on investment in dollar-denominated bonds than previously estimated. This impact of the Fed’s projections on the markets gives a short-time boost to the US currency.

It remains to be seen how sustainable this impact will be. Following the initial impulse in favour of the dollar, there seems to be a return to moderate pressure on the American currency by the start of trading in Europe.

Even more remarkably, the USDJPY quickly returned to 105 after a brief upward jump. The GBPUSD rolled back on Wednesday from 1.3000 to 1.2900 but managed to win back almost half of its decline on Thursday morning. The EURUSD gained support after touching the 50-day average, and the markets returned to an interest in the Chinese yuan.

Closing the day, or better, the week, above the 50-day average for EURUSD, S&P500 and Nasdaq100 could be an essential signal of sustained dollar pressure and a sign of renewed market optimism. A failure below this line may cause increased sell-offs, calling into question the sustainability of markets without external assistance.

The FxPro Analyst Team