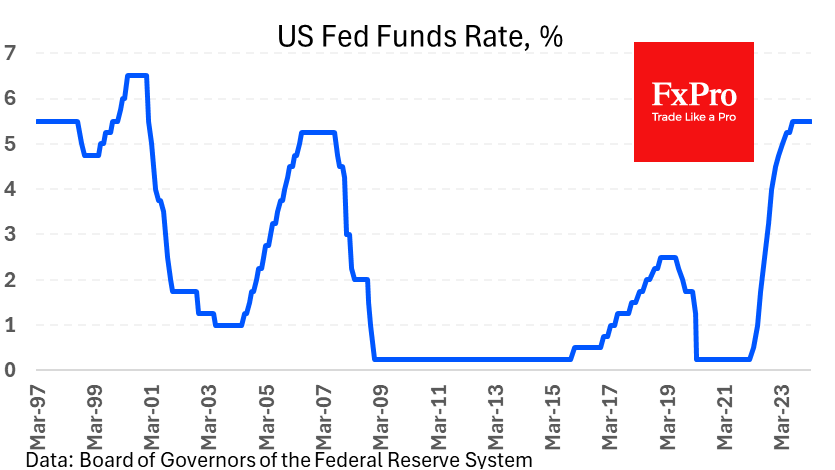

The Fed left its key interest rate unchanged, and the forecast for its reduction this year was unchanged, but it supported risk appetite in the global markets. After the announcement, the US dollar accelerated its decline, losing around 1% from peak to trough. All three major US stock indexes hit all-time highs, and gold rallied to new highs.

Markets were encouraged by Powell’s words that his view of the inflation outlook had not changed in recent weeks. Remember that during this period, inflation reports have come in above expectations and questioned the downward trajectory.

Another positive was the removal of risks that the FOMC would reduce the number of projected rate cuts.

Also positive was the confirmation of the previously announced plans to reduce the pace of securities sales from the balance sheet. This will add some liquidity to the financial system, which is supportive of risk demand, although the overall impact is relatively small.

The dollar’s reaction is in line with our earlier expectations. The Fed’s dovish tone triggered an impulsive sell-off in the dollar, with the DXY falling sharply below its 200- and 50-day moving averages.

As expected, and as we wrote before the release, the dollar’s downward momentum does not look sustainable, given the strong technical picture that has been building over the past few weeks.

From a fundamental perspective, it isn’t easy to sell the dollar when other central banks are set to follow suit. At the end of last year, there was speculation that the Fed would be the first to ease, which weakened the dollar. However, a strong economy and labour market have levelled the playing field. In addition, the SNB unexpectedly cut rates by 25 basis points on Thursday, highlighting Europe’s willingness to ease.

The expected synchronised easing by the world’s major central banks is feeding buyer interest in equity markets.

The FxPro Analyst Team