The lack of a killer dovish catalyst from the latest Federal Reserve meeting triggered a near-term rally in the dollar as sizable short positions in the under-pressure currency were unwound. Despite Chair Jerome Powell emphasizing unprecedented accommodative policy for at least three years in Wednesday’s Fed statement, a dollar gauge made its first advance in five days on Thursday to rise as much as 0.4%. It steadied on signs short-term position re-balancing was complete.

Overambitious expectations for a dovish strategy and some disappointment at the level of ambiguity in the central bank’s guidance prevented a knockout blow on the beleaguered greenback. Traders “may be further exiting speculative dollar shorts which were built pre-FOMC in expectation of a very dovish outcome,” said Imre Speizer, market strategist at Westpac Banking Corp. “It wasn’t dovish enough for some.”

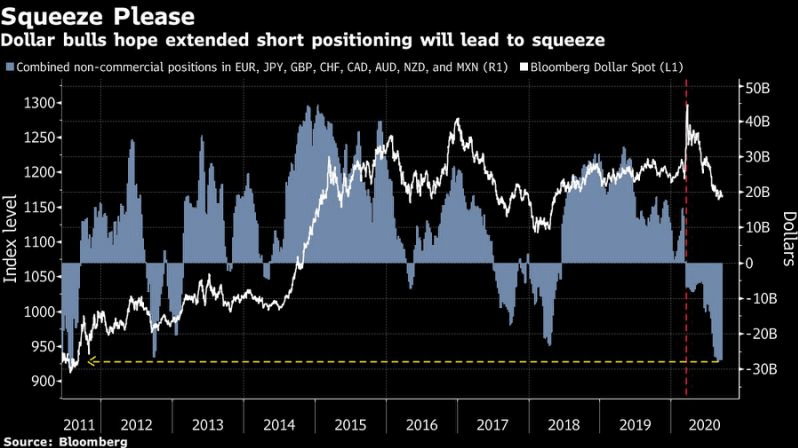

Continued dollar strength could begin to worry traders behind the more than $27 billion in net speculative short positions in the dollar, close to the largest seen since 2011, according to data compiled by Bloomberg’s Cameron Crise. Speculators turned bearish on the currency in mid-March, the data showed, after which the dollar slumped almost 7% to its lowest in more than two years.

In Europe the common currency fell a third day against the greenback, slipping as much as 0.7% to $1.1738, the lowest level in five weeks. It had strengthened almost 12% against the greenback since its March low before falling back from the $1.20 level as the greenback mounted a recovery.

The euro’s retreat comes after European Central Bank President Christine Lagarde warned Monday that its appreciation had partly offset the benefits of ECB stimulus, after earlier saying that the exchange rate needs to be monitored.

Fed Decision Leaves Forex Market Set for Dollar Short Squeeze, Bloomberg, Sep 17