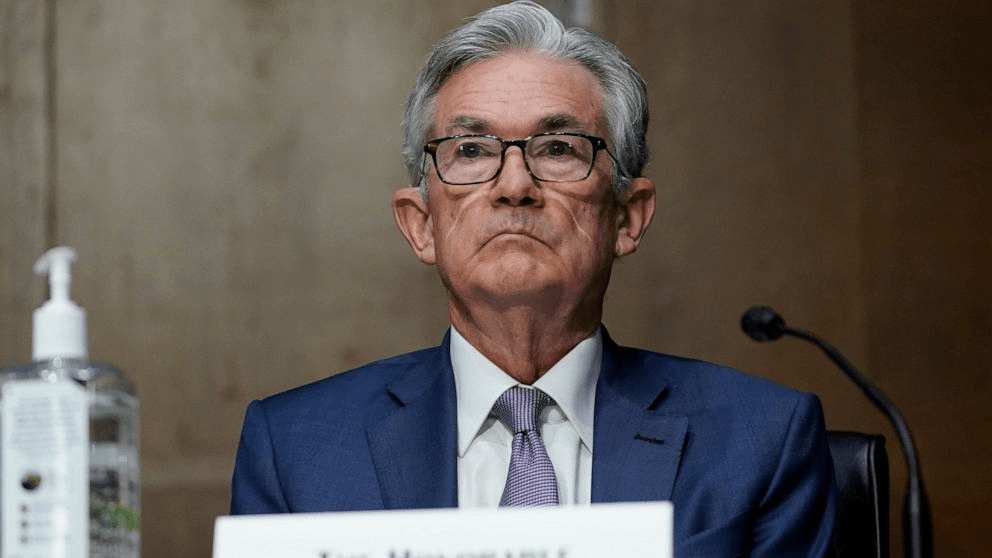

Federal Reserve Chairman Jerome Powell said Thursday that he expects some inflationary pressures in the time ahead but they likely won’t be enough to spur the central bank to hike interest rates. “We expect that as the economy reopens and hopefully picks up, we will see inflation move up through base effects,” Powell said during a Wall Street Journal conference. “That could create some upward pressure on prices.”

Markets reacted negatively to Powell’s comments, with stocks sliding and Treasury yields jumping. Some investors and economists had been looking for him to address the recent surge in rates, with a possible nod toward adjusting the Fed’s asset purchase program. The Fed currently is buying $120 billion a month in Treasurys and mortgage-backed securities. Recent market chatter has revolved around the central bank potentially implementing a new version of “Operation Twist,” in which it sells short-term notes and buys longer-dated bonds.

According to Fed officials, the central bank is far from any action to try to influence the long end of yields, despite expectations from economists and Wall Street strategists, CNBC’s Steve Liesman reported. Powell instead reiterated past statements he has made on inflation in saying that he doesn’t expect the move up in prices to be long lasting or enough to change the Fed from its accommodative monetary policy. He did note that the rise in yields did catch his attention, as have improving economic conditions.

The Fed likes inflation to run around 2%, a rate it believes signals a healthy economy and provides some room to cut interest rates during times of crisis. However, the rate has run below that for most of the past decade and inflation has been particularly weak during the coronavirus pandemic. With the economy increasingly back on its feet, some price pressures are likely to emerge, said Powell, but he added they likely will be transitory and look higher because of “base effects,” or the difference against last year’s deeply depressed levels just as the Covid-19 crisis began. Raising interest rates, he added, would require the economy to get back to full employment and inflation to hit a sustainable level above 2%. He doesn’t expect either to happen this year.

Fed Chairman Powell says economic reopening could cause inflation to pick up temporarily, CNBC, Mar 5