Federal Reserve Chairman Jerome Powell has exacted a mighty toll from stock market investors this year, according to analysts from JPMorgan Chase & Co. According to researchers led by quantitative analyst Marko Kolanovic, stocks have suffered around $1.5 trillion in losses following speeches from the Fed’s top dog.

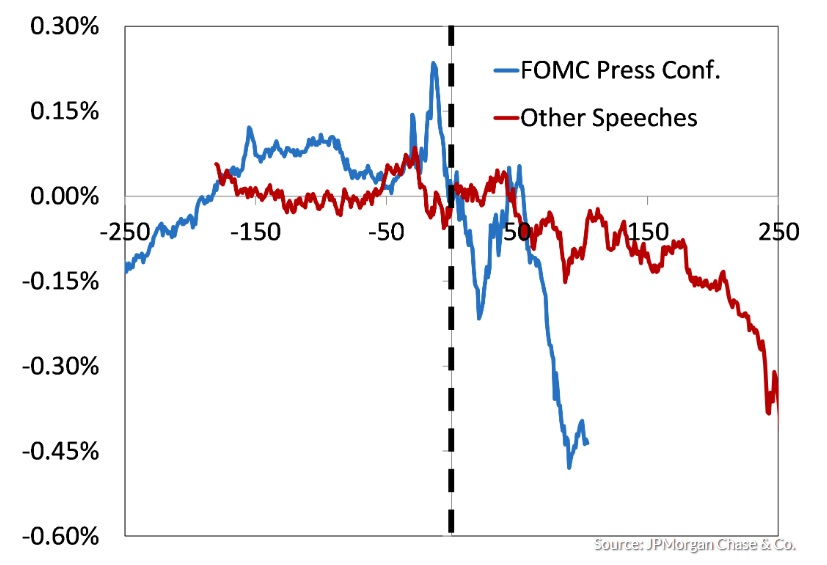

Powell has hosted three news conferences this year following meetings of the rate-setting Federal Open Market Committee. Kolanovic & Co. said they were followed by an average decline of 0.44 percentage point in the S&P 500. Other talks and speeches have resulted in an average fall of 0.40 percentage point, with losses coming in five of the past nine prominent speeches or Congressional testimonies he has delivered.

The JPMorgan Chase chart below illustrates the moves, with testimonies represented in red and FOMC news conferences in blue, before and after the start of Powell’s comments: To be sure, the research team acknowledges that directly attributing a market reaction to Powell’s comments is folly—in other worlds, correlation doesn’t mean causality, as former Fed Chairwoman Janet Yellen was known for saying—but the researchers note that there is an uncanny relationship between Fed chief’s remarks and market action.

The fear that the Fed may risk a misstep as it attempts to deftly normalize interest rates from crisis-era levels without capsizing an economy that has been spurred by late-2017 corporate tax cuts and equally buffeted by the threat of escalating trade tensions between the U.S. and China has been among the key reasons for the market’s propensity to jerk lower.

Higher yields and a stronger dollar can depress revenues of multinational companies. That said, the Dow is up 8.5% so far this year, while the S&P 500 has advanced 9.4% and the Nasdaq is on pace for a 16.3% year-to-date return.

Fed Chairman Powell has cost stock-market investors $1.5 trillion in 2018, say JPMorgan analysts, MarketWatch, Oct 04