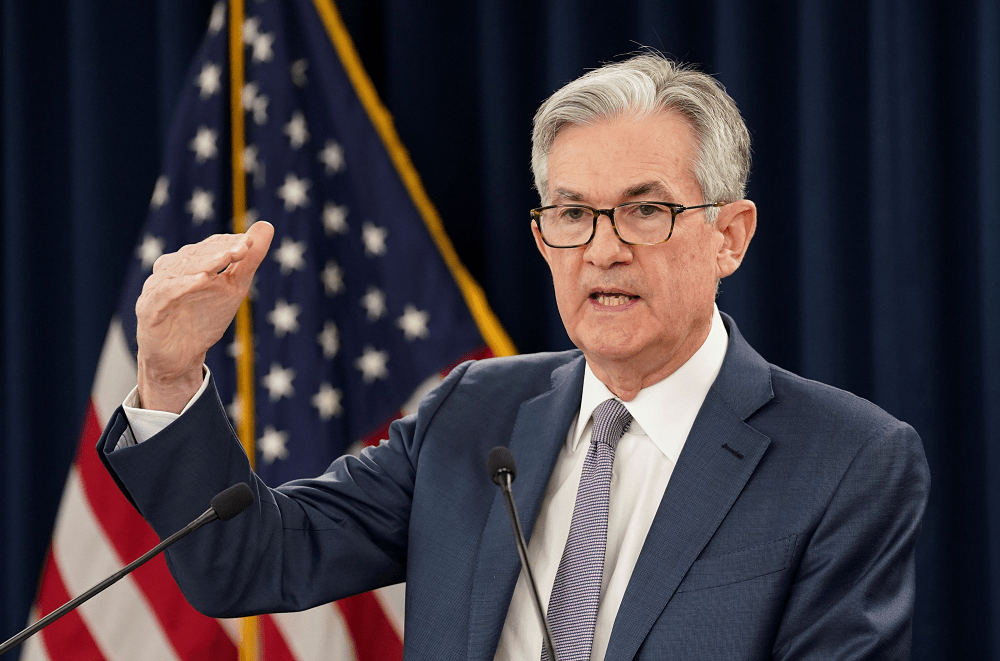

Federal Reserve Chairman Jerome Powell called Tuesday for continued aggressive fiscal and monetary stimulus for an economic recovery that he said still has “a long way to go.” Noting progress made in job creation, goods consumption and business formation, among other areas, Powell said that now would be the wrong time for policymakers to take their foot off the gas.

Doing so, he said, could “lead to a weak recovery, creating unnecessary hardship for households and businesses” and thwart a rebound that thus far has progressed more quickly than expected. “By contrast, the risks of overdoing it seem, for now, to be smaller,” Powell added in remarks to the National Association for Business Economics. “Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster if monetary policy and fiscal policy continue to work side by side to provide support to the economy until it is clearly out of the woods.”

The remarks come amid conflicting signs for an economy trying to shake off the unprecedented impacts of the Covid-19 pandemic. While 11.4 million jobs lost during the associated economic shutdown have been recovered, nearly half of displaced workers remain sidelined. GDP is expected to show a sharp rebound from the 31% second-quarter plunge and housing has been a strong point as well.

Fed Chair Powell calls for more help from Congress, says there’s a low risk of ‘overdoing it’, CNBC, Oct 6