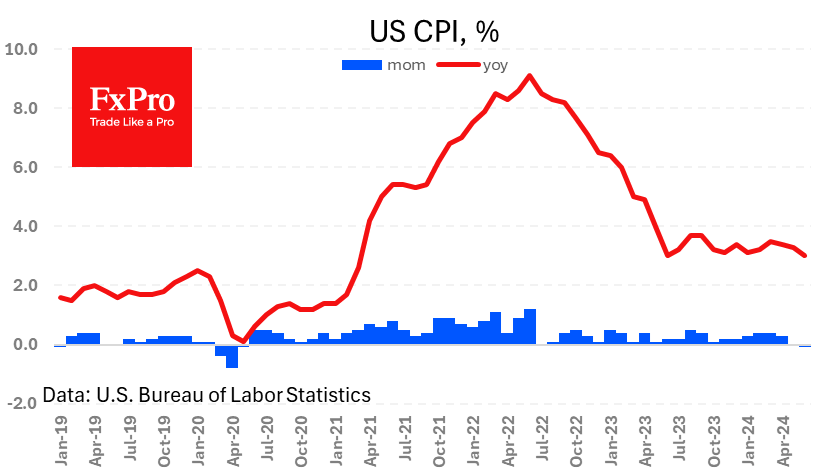

The US consumer price index fell 0.1% instead of the expected 0.1% increase, slowing annual inflation to 3.0% from 3.3% last month and below the expected 3.1%. The price index excluding food and energy slowed to 3.3%, also weaker than expected.

The faster inflation slowdown prompted a reassessment of policy rate forecasts. According to the FedWatch tool, traders now see a 45% chance of three or more rate cuts by the end of the year, up from 27% a day ago and 14.5% a month ago.

This is negative news for the dollar and positive for global demand for risk assets, including equities and gold. US indices continue to hit all-time highs on a daily basis, and the sentiment index has returned to “greed” territory. The price of gold passed $2410 per ounce. The price was above this level only between the 17th and 22nd and for a few minutes on the 12th and 19th.

The FxPro Analyst Team