The US housing sector has entered a cooling down phase, giving rise to sometimes very alarmist comments that this is the beginning of a significant collapse, comparable to the failure during the global financial crisis. But we don’t tend to dramatise the situation just yet, drawing attention to the high base.

The S&P Case-Shiller price index published on Tuesday marked the second consecutive month of decline in August, down 0.86% from 0.45% a month earlier. Data from the Federal Housing Finance Agency (FHFA) showed a 0.7% fall in August after a 0.6% fall in July.

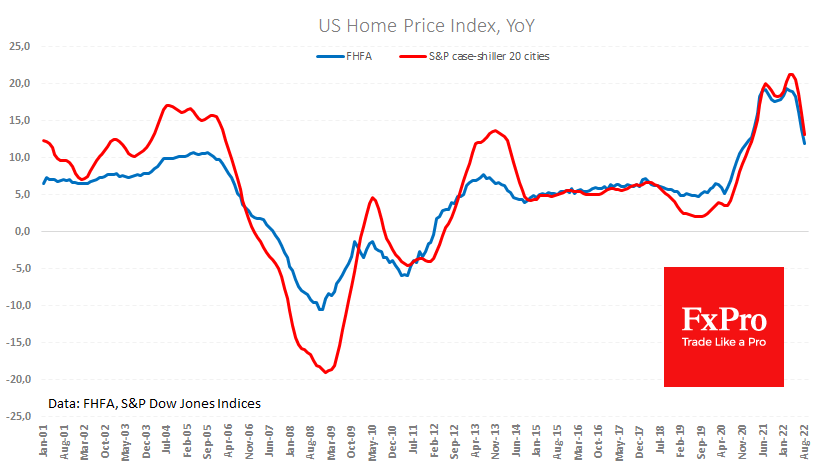

The year-on-year growth rates retreated from a peak of 21% and 19% at the start of the year to 13% and 11.9%, respectively.

However, a look at the absolute values of the above indices only shows a return to trend levels after the market bubble from September 2020. The difference from the early 21st century is in the level of consumer debt. Moreover, fighting price pressure is now the Fed’s top priority.

In 2007-2012, price declines were despite the Fed’s attempts to ease policy by pushing mortgage rates to historical lows to stimulate lending. Now mortgage demand has fallen to its lowest levels since 1997, as fixed 30-year rates have risen to 7.16% after a rate hike in key interest rates not seen in 40 years.

The US economy officially entered recession in early 2008, a few months after the annual house price trend turned negative. We now see double-digit price growth rates, double the “norm” between 2014 and 2020.

The housing market is often seen as a leading indicator of the economy, which is why many commentators rush to call two consecutive months of falling prices an omen. However, it is better to look at other indicators for signs of recession, and the housing market is just cooling a bit down from historic overheating.

The FxPro Analyst Team