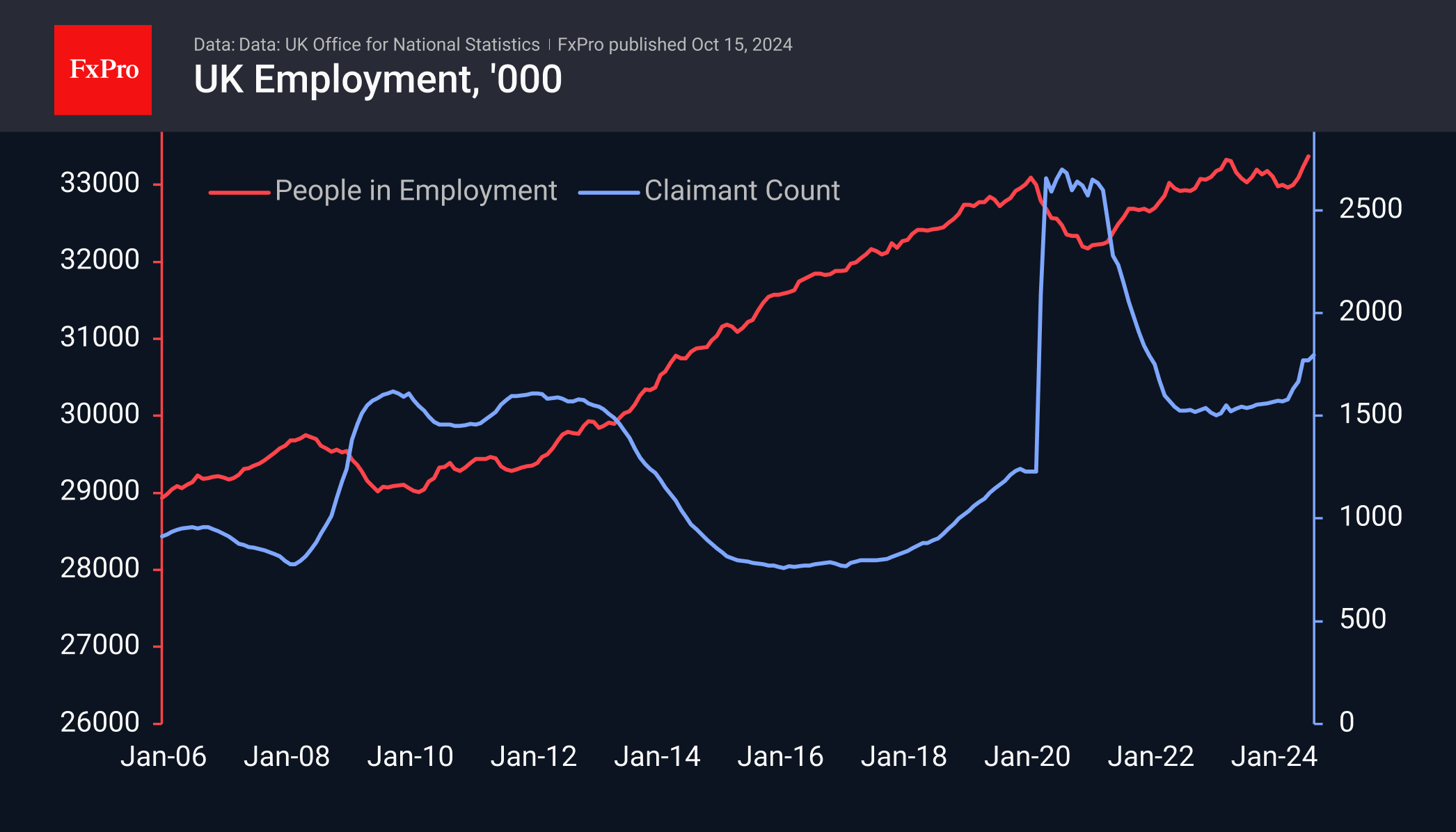

The UK unemployment rate fell to 4.0% in August, the lowest since January, and went down from a peak of 4.4% in April and May. The data beat expectations and supported Sterling buying from intraday lows below 1.3040. Employment figures have been gaining momentum in recent months, with 373K more jobs created in July and August than in the previous three months.

However, the situation is not so rosy when looking at the figures in a broader context. Firstly, the ONS publishes its preliminary estimates for September, which show a fall of 15k in the number of people in work. Second, the number of people claiming unemployment benefits rose by 27.9K in September, bringing the total over the past six months to almost 225K. Thirdly, job vacancies fell by 34K in the three months to September, confirming the cooling of the labour market.

The continued slowdown in wage growth is also worrying. They were 3.8% higher in the three months to August than in the same period a year earlier. Excluding bonuses, the increase was 4.9%. This is above the 2.2% inflation rate but builds on a slowing trend that has been in place since the middle of last year.

The markets seem to have used the new data to take profits from the previous decline in the GBPUSD. The pair has gained 0.2% since the start of the day and has climbed to the 1.3080 level, last Thursday’s high. Technically, there are no significant obstacles to the upside until the 1.3115 area, which is the 50-day moving average and the area of the previous consolidation in early October.

In a more bullish scenario for the Pound, a full-blown corrective bounce could develop into the 1.3120-1.3180 area, but further gains will require more than a portfolio shake-up—a more global shift in sentiment is needed.

The FxPro Analyst Team