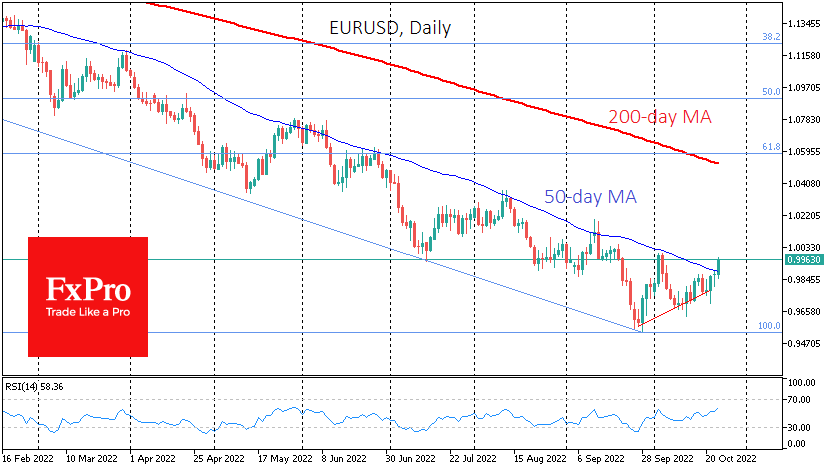

EURUSD continues to draw an almost perfect downward trend. Since the end of February, the 50-day moving average has repeatedly acted as resistance. This week we see another test of this line, which has fallen to the area of 0.9900.

It is still difficult to find hard data supporting a reversal, but there is no such thing as a no-trend in the key currency pairs, so forex traders are keeping a close eye on various reversal signals.

On Tuesday, EURUSD broke above 0.99, where the 50-day moving average is located. And now all eyes are on whether it will manage to stay above this signal line.

The bulls also have a local rising trend that has been formed in the pair since the end of September. The daily charts clearly show how the buyers support the EUR from higher and higher levels.

Another important signal of a trend break is the 1.0 level, which is a psychologically crucial round level, the area of the highs in early October and a significant support area from mid-July to the end of September.

A return of the EURUSD above parity would signal a strong start of a full-scale correction (at least), with a potential target of 1.06 (61.8% of the May 2021-September 2022 decline). This is also a significant breakout area for the pair in March 2020 and May-June 2022.

The FxPro Analyst Team