The single currency is losing ground against the dollar, pulling back to 1.13 on weak PMIs. This helps the 1.12-1.15 area cement its title as a multi-year pivot area. However, today’s momentum may prove to be just a short game within a longer-term uptrend towards 1.20-1.25.

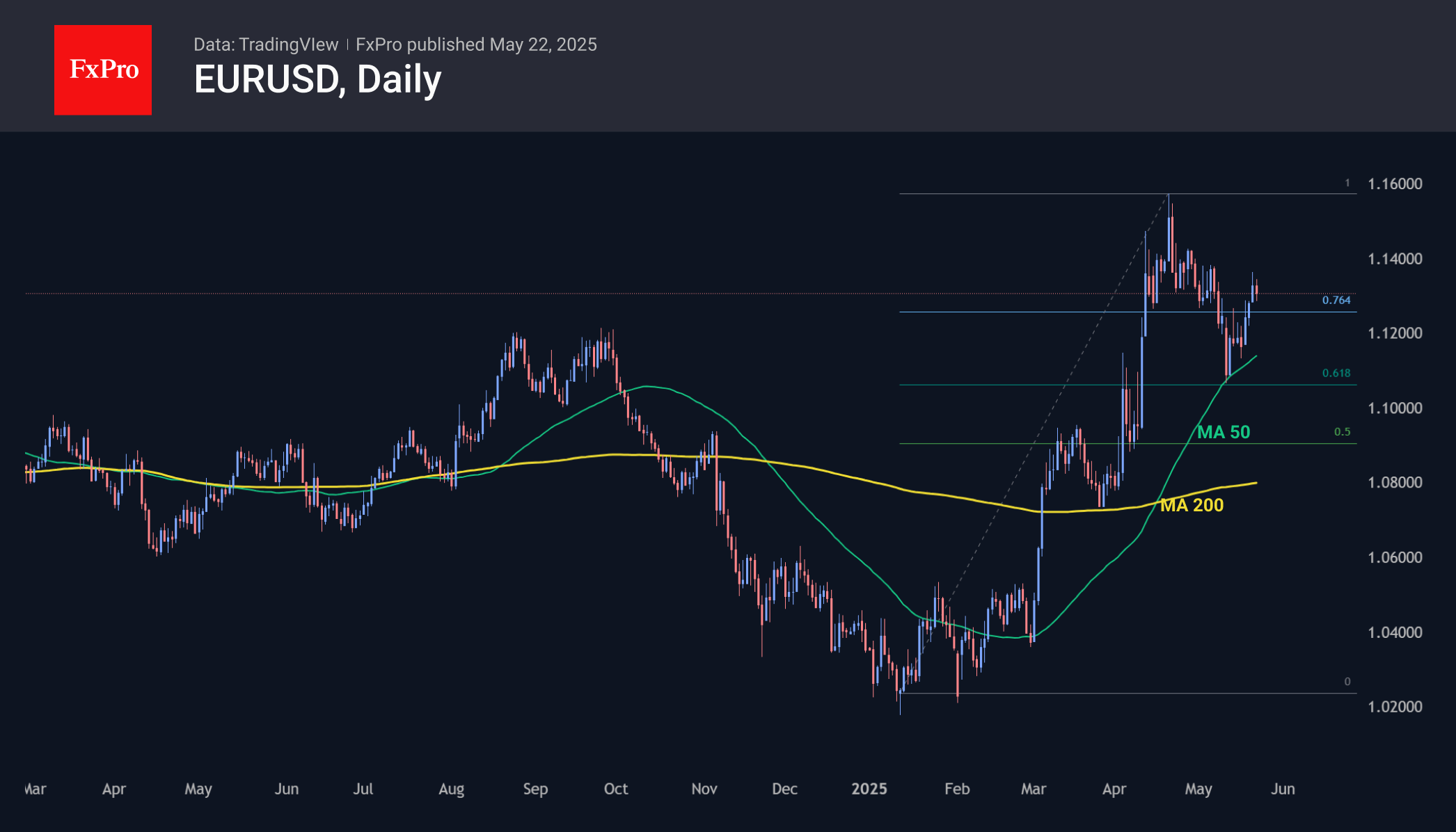

On the daily timeframes, EURUSD pushed away from the 50-day moving average in March, starting a rapid rise and later breaking above the 200-day. From late April to mid-May, the overheated market corrected within a classic Fibonacci pattern, and EURUSD regained support at the 50-day touch.

The recovery of the uptrend reinforces our belief that we have seen a corrective pullback and not a reversal. This is also evidenced by the fact that EURUSD quickly returned above 1.12, which served as a reversal point from upside to downside for the previous two years. Now it is working as support.

Only overcoming the previous peaks at 1.1570 will confirm the uptrend. However, a bullish signal is already forming on the weekly timeframes—a golden cross, as the 50-week moving average is preparing to exceed the 200-week moving average.

A consolidation above the broad 1.05-1.12 corridor is likely to be followed by an entry to a new floor with support at 1.12 and resistance in the 1.25 area, where the market reversed down in 2018 and 2021, but from 2008 to 2014 the ‘ceiling’ of this range was support for the pair.

That is, the EURUSD’s corrective pullback since late April could be just a tactical consolidation of forces before a further breakout with a long-term target at 1.25.

The FxPro Analyst Team