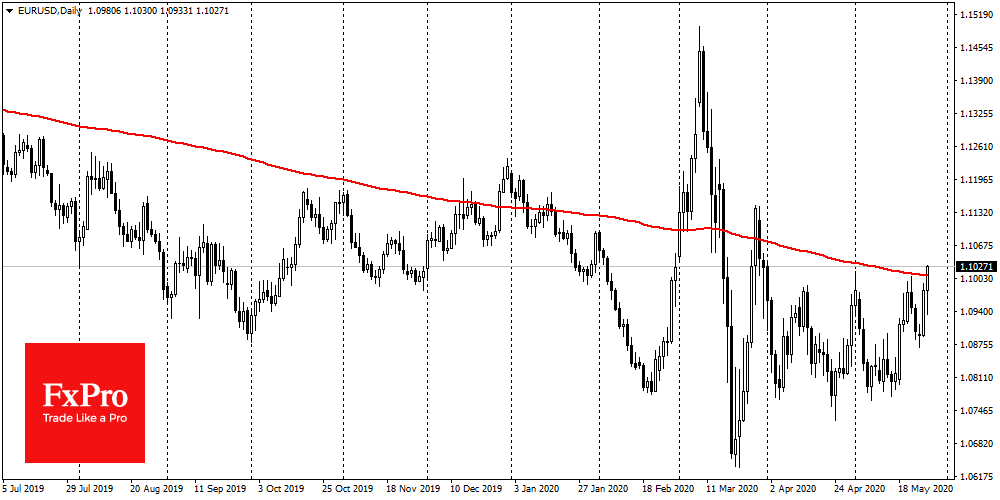

EURUSD turned to growth and approached 1.1000, near which the 200-day average passes. On the news about the upcoming 750B euro stimulus package, EURUSD has jumped above these lines. Both are psychologically important. Their breakdown often leads to a significant increase in purchases. Also, for the euro, this may be a signal for the end of the downtrend since 2018.

Before one jumped into the market, it is prudent to wait for the end of this epochal battle of bulls and bears. It should be borne in mind that the pair “likes” to make false breakdowns of the 200-day average, but then returns to the prevailing trend. It is more careful to give time until the end of the month.

We are now witnessing a similar battle for the 200-day average and psychologically important round level of 3000 at S&P500. It may well turn out that both essential instruments for world markets synchronously successfully overcome them or fail. And this will be the strongest signal, perhaps for several months or even quarters ahead. It is better not to rush and wait for confirmation with closing the week and month below or above 200-day averages and marks of 1.1000 and 3000 for EURUSD and S&P500, respectively.

The FxPro Analyst Team