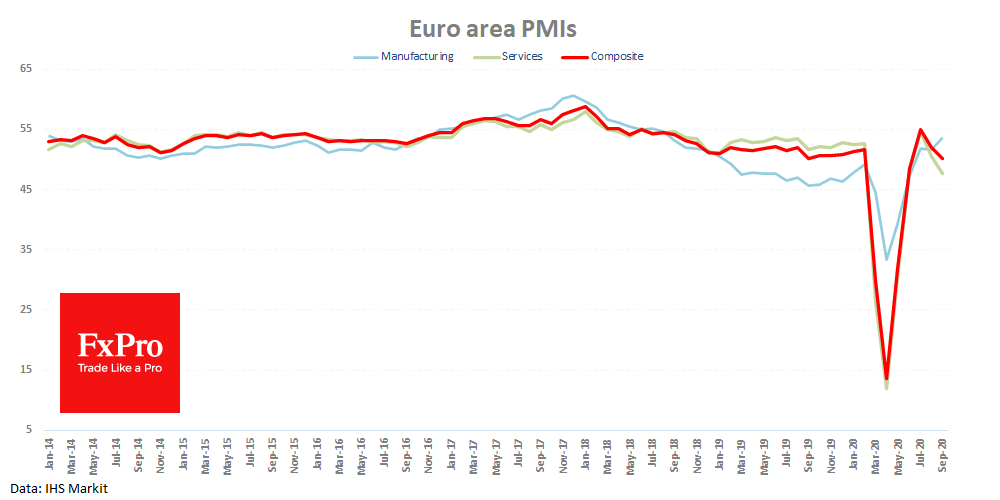

The increase in the number of new COVID-19 cases in Europe has hurt business activity indices. One after another, preliminary PMI estimates from European countries fell short of expectations. The service sector of the euro area has returned to decline. Although manufacturing has mostly exceeded expectations, the PMI Composite index has been dragged down by Services.

Strong Manufacturing performance is good news for Germany and provided short-term support for the euro, which now has a chance to counteract the dollar’s growth impulse.

In general, investors and traders of the euro should note the speed in which the Composite index returned dangerously close to the level separating decline from growth.

This is yet another reminder of how fragile the recovery in the eurozone is. The same indices for the USA published a few minutes ago managed to exceed expectations by remaining firmly in the growth area. This data could extend the momentum of the euro’s decline against the dollar in the coming days.

The FxPro Analyst Team