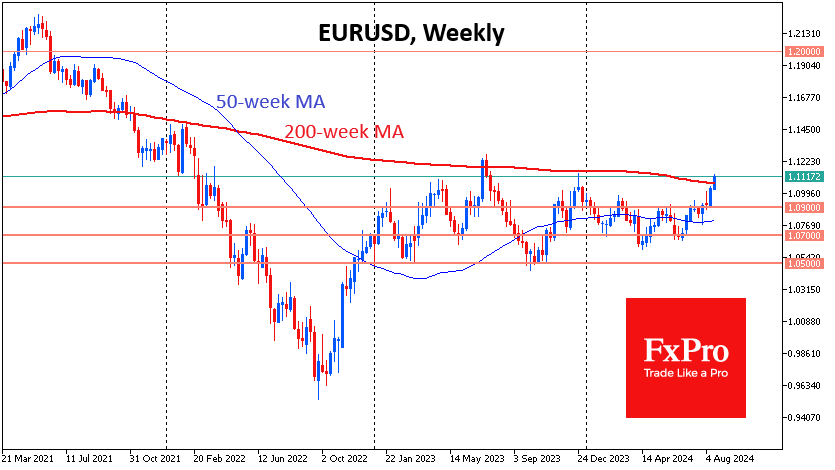

The single currency has risen above $1.11, almost repeating its late December peak. At current levels, the pair is within the upper boundary of its trading range, and the technical analysis suggests that a breakout is more likely than a pullback.

Thanks to two bullish impulses since the beginning of July, EURUSD has moved from the lower boundary of the trading range established in early 2023 at 1.07 to the upper boundary above 1.11.

Since the beginning of this week, active buying has pushed the pair above its 200-week moving average. This could potentially be an important signal of a regime change in the market, although cautious players may note that the same signal proved false last July and lagged severely in 2012 and 2017.

The daily timeframes show overheating as the RSI has climbed close to 75, the level from which an 11-week sell-off began in July 2023.

However, the major moving averages are bullish. A ‘golden cross’ was formed earlier this week, with the 50-day moving average above the 200-day moving average. Both are below the price, which also adds to the bullishness. The subsequent rally in the EURUSD has confirmed this important technical signal for many managers.

However, even this bullish technique needs fundamentals. The markets will need to dig deeper into the minutes of the latest Fed meeting, which will be published at the end of Wednesday. Powell’s live speech at Jackson Hole on Friday is still highly influential and could answer the question of whether the Fed is considering a 50-point rate cut next month.

Of note on Wednesday is the annual revision of US employment data, which could dramatically change the picture of the economy in recent months. Some observers are talking about a possible downward revision of 0.6-1.0 million jobs for the year. The latest weak jobs data was extremely painful for traders earlier this month, triggering a sell-off in equities despite a surge in rate cut expectations. Will this scenario be repeated?

The FxPro Analyst Team