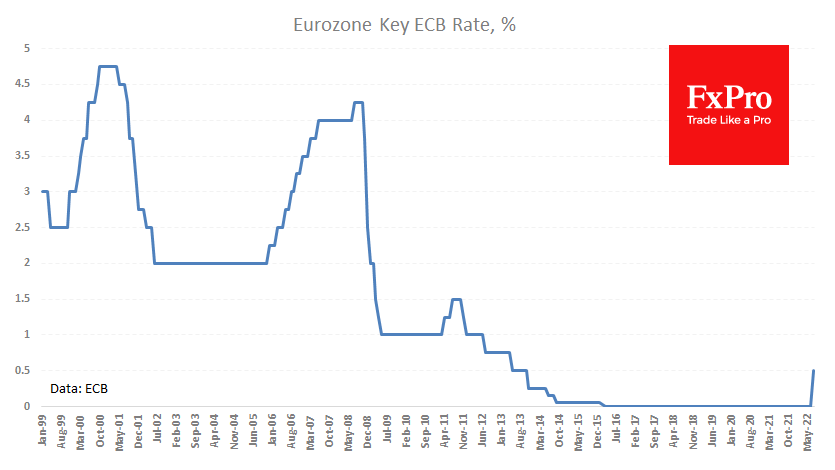

The European Central Bank increased its key rate by 50 points to 0.50%. This is more than average analyst forecasts, based mainly on old comments from Bank members. However, rumours of a more decisive move surfaced in the last few days when a period of silence was already in effect. This situation repeated what we saw before the last Fed meeting. The new “expectation management” techniques seem to be spreading fast.

Nevertheless, the euro’s reaction to the rate hike shows that the market has not fully priced in the 50-point hike step. EURUSD is adding 0.65% after the announcement, rising to 1.0260.

The EURUSD pair is testing 2-week highs, returning to the upper boundary of this week’s trading range and rejecting the negative vibe caused by the Italian political crisis and Prime Minister Draghi’s resignation.

However, the current rebound in the euro is still far from the beginning of a recovery. The bulls will have to endure more diverse tests to confirm a full-fledged reversal in the pair.

Right now, the EURUSD growth looks like just a technical rebound after a long decline. It can be considered more significant after a substantial consolidation above 1.0350 (previous global and local lows). A pullback above the 50 SMA, which is near 1.0450, may seal the break-up of the bearish trend.

Amongst the significant fundamental obstacles to the appreciation of the single currency are the European economy, which is deeply mired in an energy crisis, and the extremely high debt/GDP ratios of some of the larger economies, which reduce the scope for fiscal stimulus. Thus, there are many questions about the sustainability of EURO growth in the near term despite a seemingly decisive ECB rate hike.

The FxPro Analyst Team