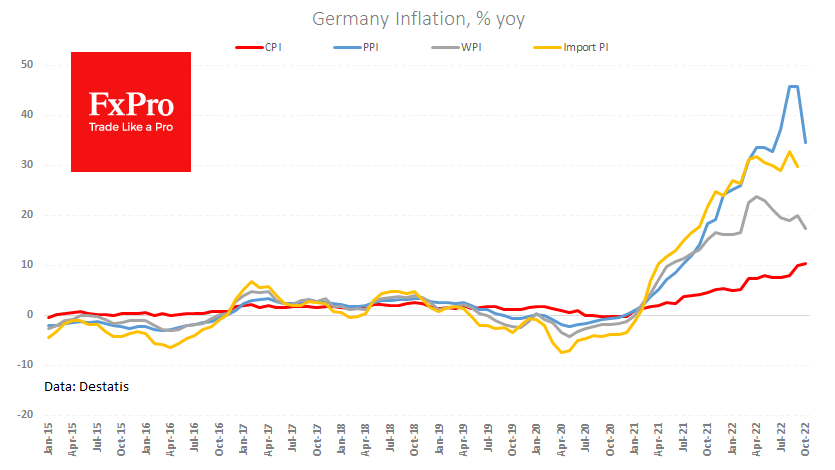

German producer prices lost 4.2% in October; its year-over-year growth rate slowed dramatically by 11.3 percentage points. This is an important and necessary reversal of the inflation trend that Europe’s largest economy has been waiting for.

At the same time, it is worth bearing in mind that inflation has climbed too high, accounting for 45.8% y/y in producer prices in the previous two months, and regulators are looking with great concern at how broadly it will be beyond energy and food.

Not surprisingly, we saw the first signs of a trend reversal in import prices (-0.9% m/m and slowing from 32.7% to 29.8% yoy in September). In October, we see an impressive drop in producer prices, supported by a cut in wholesale selling prices.

If we look at the situation straightforwardly, the October price decline is an argument against the euro as it brings us somewhat closer to the point at which the ECB will stop its rate hikes. But at the same time, we should remember that the ECB overslept the moment when it should have started its fight against inflation, which took it to higher levels compared to the US and Switzerland.

Also, what is most worrying for central banks worldwide is that the longer prices rise at an elevated rate, the more it begins to be regarded as the norm. The inertia of the ECB could well manifest itself in the fact that it will raise rates after Q1 2023, when the Fed has already reached a plateau.

Simply put, weak eurozone inflation figures are not a problem for the euro and may even support its strength if the ECB sticks to its hawkish policy while it saves more purchasing power of money.

The FxPro Analyst Team