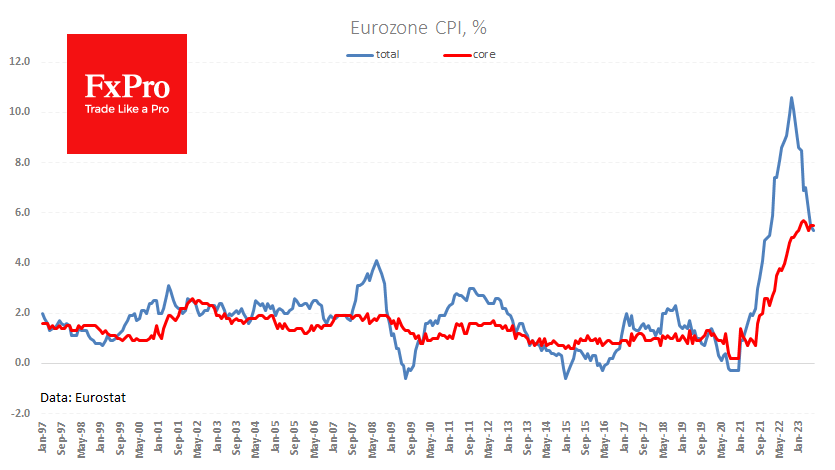

According to Eurostat’s preliminary estimate, eurozone inflation slowed to 5.3% year-on-year in July. This is the lowest rate since January 2022 and aligns with analysts’ expectations.

The core index stood at 5.5%, above the headline rate for the first time since February 2021. The momentum of this core index is coming to the forefront, and so far, there is little good news here, as the data are beating forecasts and not showing as strong a turnaround as we see in producer prices and headline inflation figures. As in the US, the likely reason is growth in the services sector after the coronavirus. The only thing that can change this situation is further tightening by the central bank, which is likely to dampen demand. The latest GDP estimates for the second quarter show that there is still room to work in this direction.

The eurozone economy grew by 0.3% QoQ after two quarters of virtually flat growth. This was despite aggressive interest rate hikes in previous quarters to dampen final demand for credit.

Better-than-expected price and GDP dynamics favour the euro, which rose for a second consecutive day on Monday after Thursday’s sell-off following the ECB press conference. We note that inflationary trends in Europe are more resilient than in the US, reviving speculation that the former will either have to raise rates more or hold them for longer. If this turns out to be the case, the uptrend in EURUSD that has been in place since September 2022 will gain traction in the coming quarters.

The FxPro Analyst Team