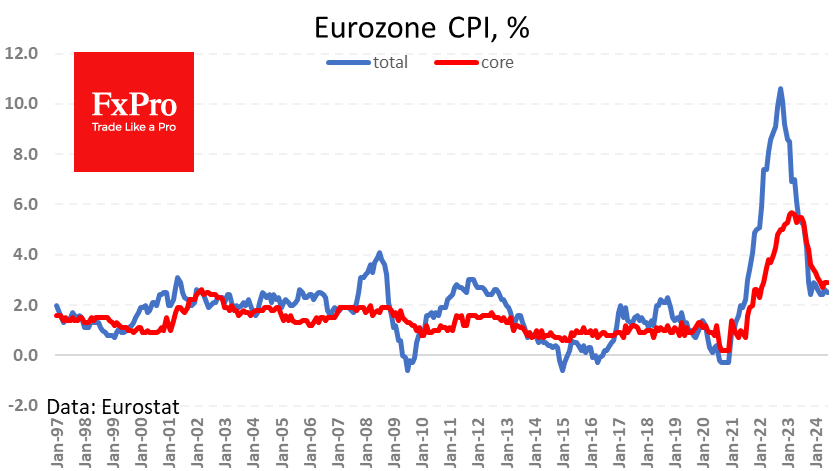

According to the Eurostat Flash estimate, the euro area CPI stood at 2.5% y/y, hovering between 2.4% and 2.6% for the past five months. There has been no apparent slowing since November when the rate first touched 2.4%.

Core CPI maintained a 2.9% y/y in May and June after touching 2.7% in April. The index has also stabilised at levels above the ‘below but close to 2%’ target for the ECB.

The stabilisation at higher levels is due to increased demand, as producer prices have been losing more than a year’s worth of annual growth, falling 5.7% y/y, according to the latest data for April.

The resilience of inflation is unlikely to allow the ECB to cut rates as aggressively as it has been raising them. This may be more akin to the 2011-2015 easing cycle than the emergency cuts of 2008-2009 or smoother 2001-2002 cuts.

Such a scenario is relatively optimistic for markets, as emergency rate cuts have come with sudden deterioration in financial conditions, requiring liquidity injections to save markets from collapse.

The FxPro Analyst Team