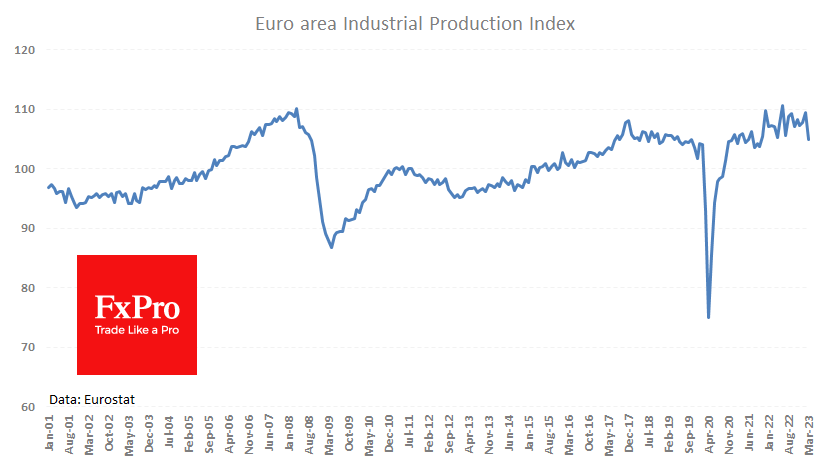

Eurostat today reported that eurozone industrial production fell by 4.1% in March, the most significant drop since July last year. Compared with the same month of the previous year, output fell by 1.4%, instead of the expected +0.9%, whereas, in February, it was up +2.0%.

The seasonally adjusted industrial production index fell to its lowest level since October 2021, failing to stick to a steady growth path and reversing down from roughly the same level it has been at since 2008. The following manufacturing report promises to be quite interesting, as it will help determine whether we see a reversal to decline, as we did in 2008 and 2018, or just a tactical retreat.

In a separate publication, German wholesale prices fell by 0.4% m/m, against expectations for a rise of 0.3%. Year-on-year, the decline is 0.5%. Import prices are also in negative territory year-on-year, which should contribute to a fall in consumer inflation.

Trends in industrial production are often ahead of the economy and determine long-term trends and the performance of the euro against the major currencies. However, they rarely cause an immediate market reaction immediately after publication.

The single currency suffered short-term losses due to weak industrial production data and falling wholesale prices in Germany. This publication did not disrupt the EURUSD’s overall intraday trend, with buying interest increasing as the pair touched its 50-day moving average near 1.0850.

The FxPro Analyst Team