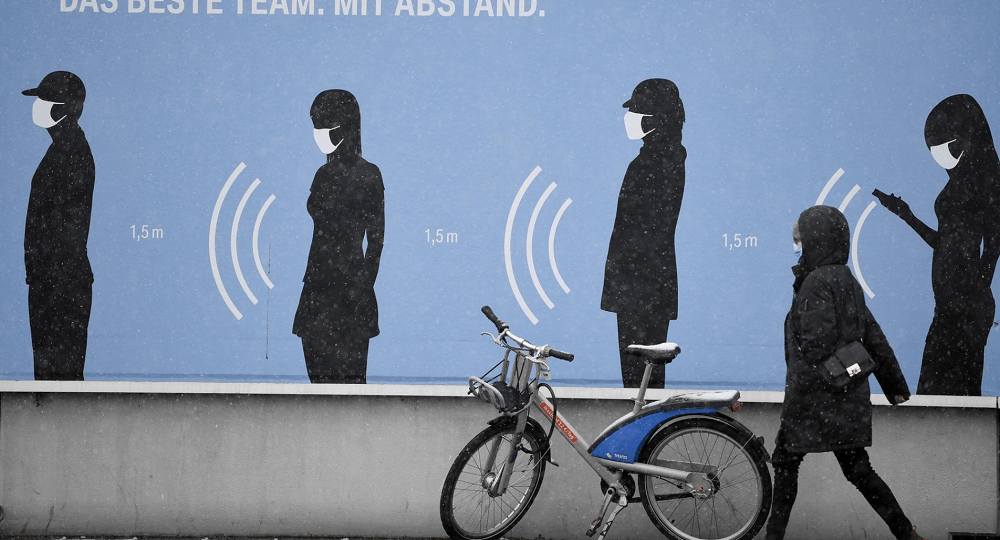

The euro zone economy is almost certainly in a double-dip recession as pandemic-linked lockdowns continue to hammer the services industry, a survey showed on Wednesday, but hopes for a wider vaccine rollout drove optimism to a three-year peak. Reported coronavirus cases have remained high across the 19-countries that use the euro and governments have forced hospitality and entertainment venues to remain closed and encouraged citizens to stay at home.

IHS Markit’s final February Composite Purchasing Managers’ Index (PMI), seen as a good gauge of economic health, rose to 48.8 from January’s 47.8, above a flash reading of 48.1 but firmly below the 50 mark separating growth from contraction. That increase was in large part due to near-record growth in manufacturing as most factories have remained open.

The euro zone economy contracted in the first two quarters of 2020 and a Reuters poll of economists last month forecast it would do so again in Q4 and the current quarter, saying risks to their already weak outlook were skewed to the downside. They cited delays to the European Union’s vaccine roll-out, concerns about new coronavirus variants supporting current lockdowns, stalled economic activity and rising unemployment as serious threats. A PMI for the dominant services industry, most affected by lockdowns, rose to 45.7 last month, ahead of January’s 45.4 and the 44.7 flash estimate but still well below breakeven.

Demand fell for a seventh month, despite firms cutting their prices, yet services businesses did increase headcount – albeit marginally – for the first time since last February, just before Europe felt the first wave of the initial pandemic. The services employment index rose to 50.2 from 49.8.

Euro zone in double-dip recession but optimism soared in February: PMI, Reuters, Mar 3