European stocks on Tuesday traded in a tight range, as one leading bank said the region was vulnerable to a stalling economy as COVID-19 cases remain elevated. Up 0.8% on Monday, the Stoxx Europe 600 SXXP, was fractionally lower. The German DAX, French CAC 40 and U.K. FTSE 100 each hugged the flat line.

U.S. stock futures eased after a 465-point advance for the Dow Jones Industrial Average on Monday. “U.S. investors appeared to welcome President Trump’s return to work, and signs of progress towards additional fiscal stimulus also contributed to the index gains,” said Ian Williams, strategist at Peel Hunt.

Strategists at Citigroup led by Robert Buckland say they are worried about “a second COVID-19 wave, more EPS downgrades, extended valuations and a chaotic U.S. election.” They downgraded their view on Continental European stocks to underweight while keeping U.K. stocks at neutral and U.S. equities at overweight. “The region’s cyclical tilt will leave it vulnerable if economic recovery stalls. A strong euro will also weigh on corporate performance,” said the strategists on European stocks.

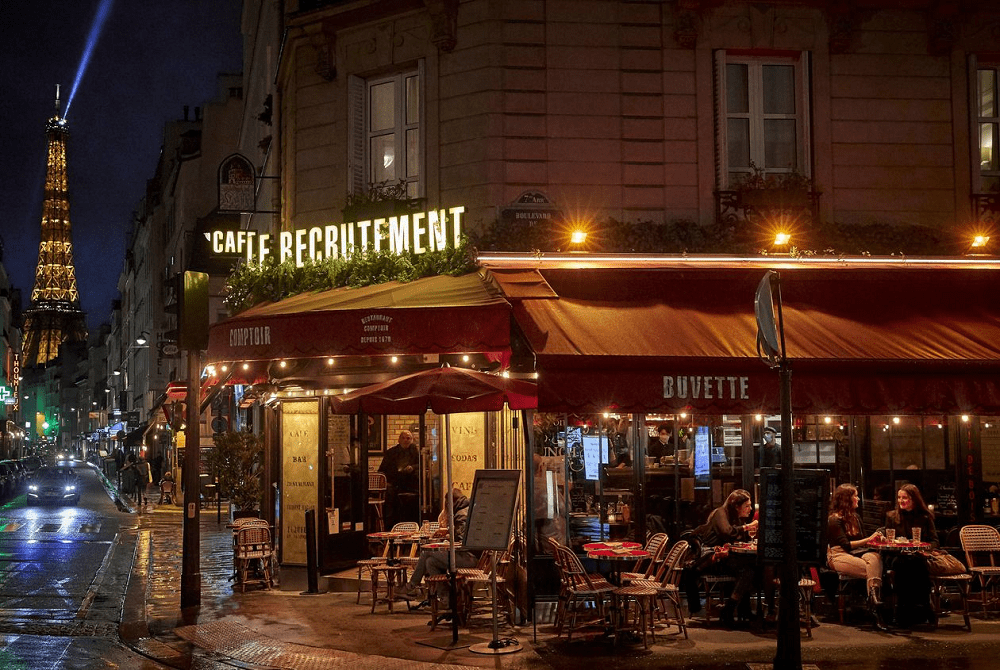

Per capita, Spain, the Czech Republic, and France have the highest number of COVID-19 cases over the last 14 days, according to the European Centre for Disease Prevention and Control.

European stocks struggle after strong day, as Citi advises underweight of the region, MarketWatch, Oct 6