The Europe Stoxx 600 rose Monday with broad gains across industry groups. Oil slumped on a price reduction by Saudi Arabia. The dollar strengthened while Treasury yields were little changed. Gold fell. Stock futures pointed to further losses for American shares when markets re-open on Tuesday after the Labor Day holiday. Valuation is emerging as a concern for U.S. investors and there’s also nervousness about extreme positions in technology stocks.

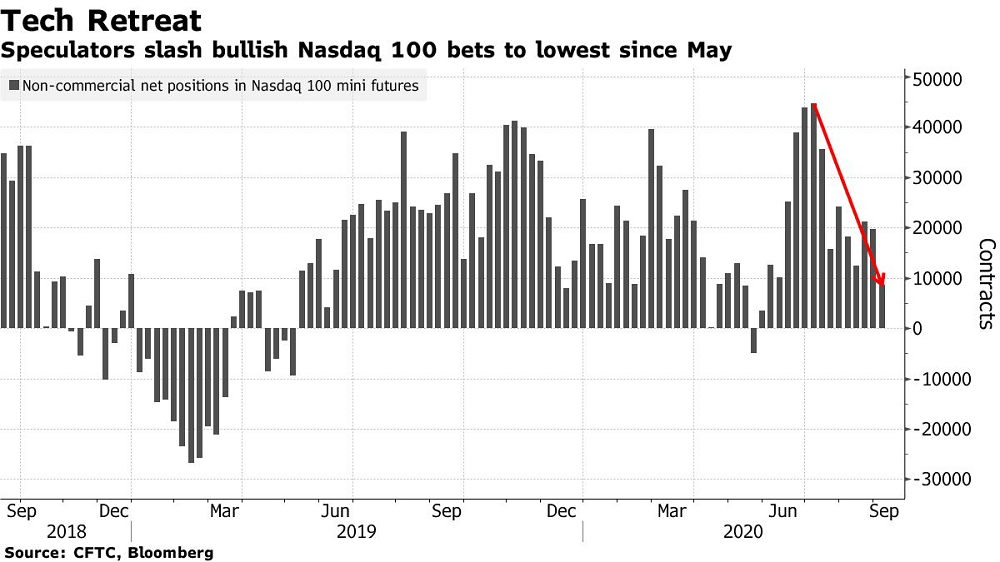

Global equities fell the most since June last week as doubt crept into investors minds about whether equities have risen too quickly and valuations are reaching extremes. U.S. technology shares, which have seen a powerful rally through the depths of the pandemic, showed signs of buckling at the end of the week amid reports that huge options bets were fanning their gains. The roller coaster ensnared SoftBank Group Corp., which slumped 7% after reports that the Japanese conglomerate made massive bets on tech-linked options trades.

Here are some key events coming up:

- The next Brexit negotiating round begins with face-to-face discussions between the U.K. and the EU in London.

- The ECB will probably hold rates on Thursday but indicate that downside risks have intensified, suggesting further easing is possible before year-end.

- U.S. CPI data is due Friday, with consumer prices expected to rise in August for a third straight month.

- These are the main moves in markets:

Stocks

Futures on the S&P 500 Index were little changed at 7:22 a.m. New York time.

Nasdaq futures dropped 0.8%.

The Stoxx Europe 600 Index climbed 1.3%.

The MSCI Asia Pacific Index declined 0.3%.

The MSCI Emerging Market Index fell 0.5%.

Currencies

The Bloomberg Dollar Spot Index increased 0.3%.

The euro decreased 0.1% to $1.1821.

The British pound dipped 0.9% to $1.3153.

The Japanese yen was little changed at 106.22 per dollar.

Bonds

The yield on 10-year Treasuries was unchanged at 0.72%.

Germany’s 10-year yield was little changed at -0.47%.

Britain’s 10-year yield sank two basis points to 0.244%.

Japan’s 10-year yield gained one basis point to 0.047%.

Commodities

West Texas Intermediate crude fell 1.4% to $39.22 a barrel.

Gold weakened 0.2% to $1,929.16 an ounce.

Brent crude declined 1.4% to $42.06 a barrel.

European Stocks Gain as Tech Wobbles Weigh on U.S., Bloomberg, Sep 7