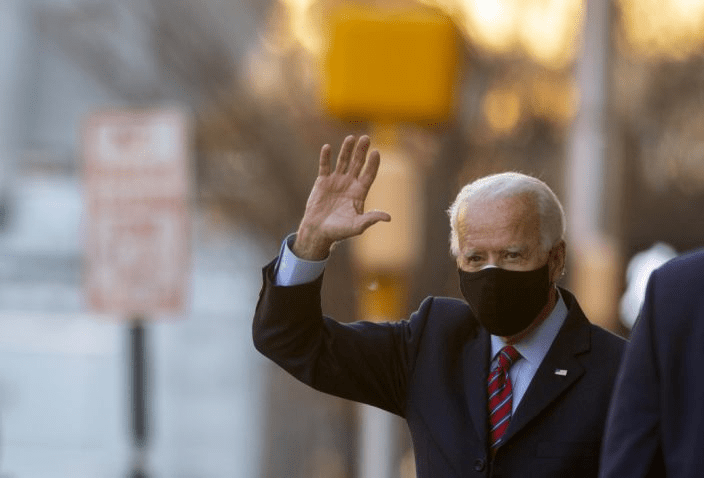

European markets gained on Tuesday as a prominent US independent agency formally accepts president-elect Joe Biden as the country’s next leader, which has added to market enthusiasm over a COVID-19 vaccine and that a global economic recovery is on its way.

On Monday, the US General Services Administration chief Emily Murphy wrote in a letter to Biden that he can formally begin the hand-over process. European markets opened in positive territory in early trading. The FTSE 100 gained 0.9% in London. In Paris, the CAC 40 and Germany’s DAX were both higher 1%.

US futures also rose. S&P futures are up 0.7%. The Dow Jones gained 0.8%. Nasdaq futures headed higher 0.5%. President Donald Trump has advised his team to “do what needs to be done with regard to initial protocols,” a sign that he is accepting the election outcome which could spell an end to his legal challenges of the results.

Markets also welcomed reports that Biden intends to nominate former Federal Reserve Chair, Janet Yellen, to become the next US treasury secretary. In Brexit news, ahead of the year-end Brexit transition deadline, UK prime minister Boris Johnson is reportedly preparing to make a significant intervention in trade talks this week as it’s claimed both sides believe a deal is within reach.

With respect to COVID-19, Johnson confirmed England’s lockdown will lift as planned on 2 December, and the country will return to a three-tier regional system with the strictest lockdowns only in virus hotspots. Risk appetite overnight in US markets was boosted by progress on COVID-19 vaccines. AstraZeneca (AZN) said its COVID-19 vaccine could be as much as 90% effective, be cheaper to make, easier to distribute and faster to scale-up than its rivals.

Asian markets were mixed. The Shanghai Composite fell 0.3% and the Shenzen Component dropped 0.4%. Elsewhere, the Hong Kong Hang Seng was up 0.3%, South Korea’s KOSPI gained 0.6%. For the day ahead, we will get get the US Conference Board’s consumer confidence indicator for November, the Richmond Fed’s manufacturing index and the FHFA’s house price index for September.

We will also hear from European Central Bank (ECB) president Christine Lagarde, the ECB’s member of the executive board Philip R. Lane, Saint Louise Fed president James Bullard, Fed Reserve president and chief executive John C. Williams and the BoE’s Monetary Police Committee member Jonathan Haskel.

European markets rejoice as Biden transition begins, Bloomberg, Nov 24