European markets opened lower Friday as concerns about spiking coronavirus cases in the U.S. and elsewhere continue to weigh on the broad recovery rally. The pan-European Stoxx 600 fell 0.5% at the start of trading, oil and gas stocks dropping 1.1% to lead losses as all sectors except technology slid into negative territory.

European stocks look set to follow the overnight trend in Asia Pacific, where markets broadly retreated as an absence of significant economic data left anxiety around the virus to dominate investor sentiment.

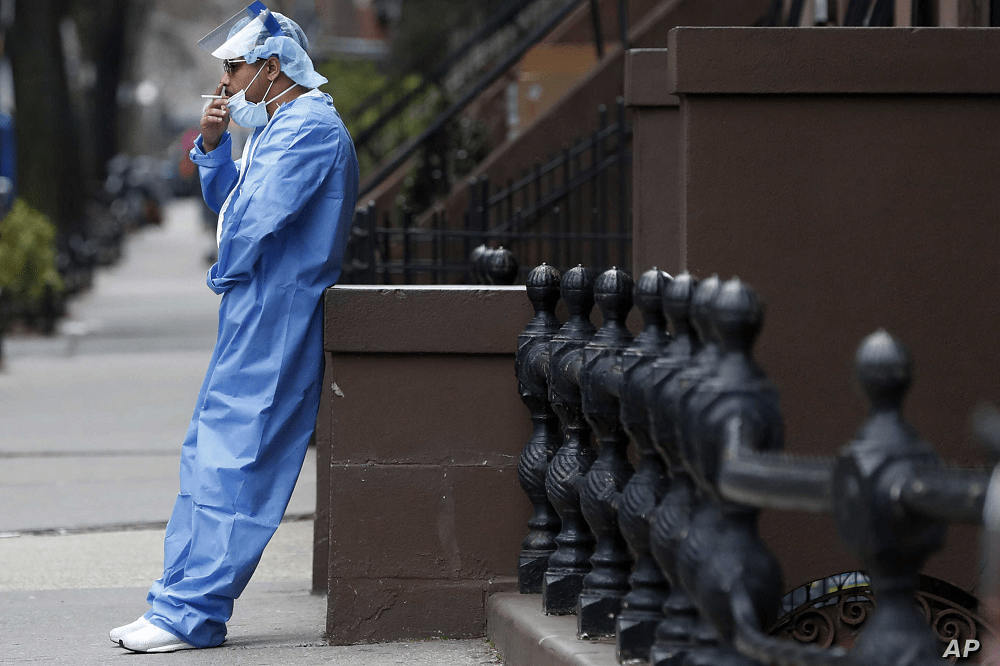

The U.S. saw infections rise again on Thursday, with California and Florida among 12 states breaking records on seven-day averages for daily new cases, CNBC analysis showed. A Reuters tally indicated that more than 60,500 new cases were confirmed nationwide Thursday, a fresh daily record.

The World Health Organization cautioned that the virus is “getting worse” in most of the world, with more than 12.2 million confirmed cases globally, according to Johns Hopkins University.

The Australian city of Melbourne is in lockdown once again following a spike in cases as Australian authorities consider slowing the return of citizens amid an outbreak in the state of Victoria, Reuters reported Thursday. Meanwhile, all schools in Hong Kong will be closed from Monday after a spike in locally-transmitted coronavirus infections, Reuters reported Friday.

Geopolitical disputes continue to simmer in the background, and the U.S. is expected to announce deferred retaliatory measures against France over its digital services tax on Friday, according to U.S. Trade Representative Robert Lighthizer.

European markets open lower as coronavirus concerns persist, CNBC, Jul 10