The potential for a protracted contest following Tuesday’s U.S. election means European markets may face a more volatile aftermath than in previous presidential races. In 2016, the shock of President Donald Trump’s victory sent European stocks south on the night, but the pan-European Stoxx 600 quickly shook it off and began a gradual incline which lasted around six months.

The European blue chip index also reacted positively to the decisiveness of former President Barack Obama’s re-election against Mitt Romney in 2012, while 2008 was something of an anomaly owing to Obama’s victory over John McCain falling during the financial crisis, with European stocks continuing to slide toward the multi-decade lows reached in March 2009.

Prior to this, following George W. Bush’s re-election against John Kerry in 2004, European markets also entered a steady period of around six months of gains. But given the risks of a disputed election and a process which rumbles on long after the polls close on Tuesday, the most comparable past scenario would be Bush’s victory over Al Gore in 2000. A contested result in the key swing state of Florida ended up in the Supreme Court, with Gore eventually conceding in late December.

Markets worldwide were roiled during the delay in 2000, but with unprecedented quantities of mail-in ballots, a host of states set for close races and multiple election-related lawsuits already underway in many areas, analysts are expecting even more turbulence in the aftermath of Tuesday. What’s more, investors may have more focus on what the election outcome means for the prospect of fiscal stimulus, with Congress having been in deadlock over a new coronavirus aid bill for months.

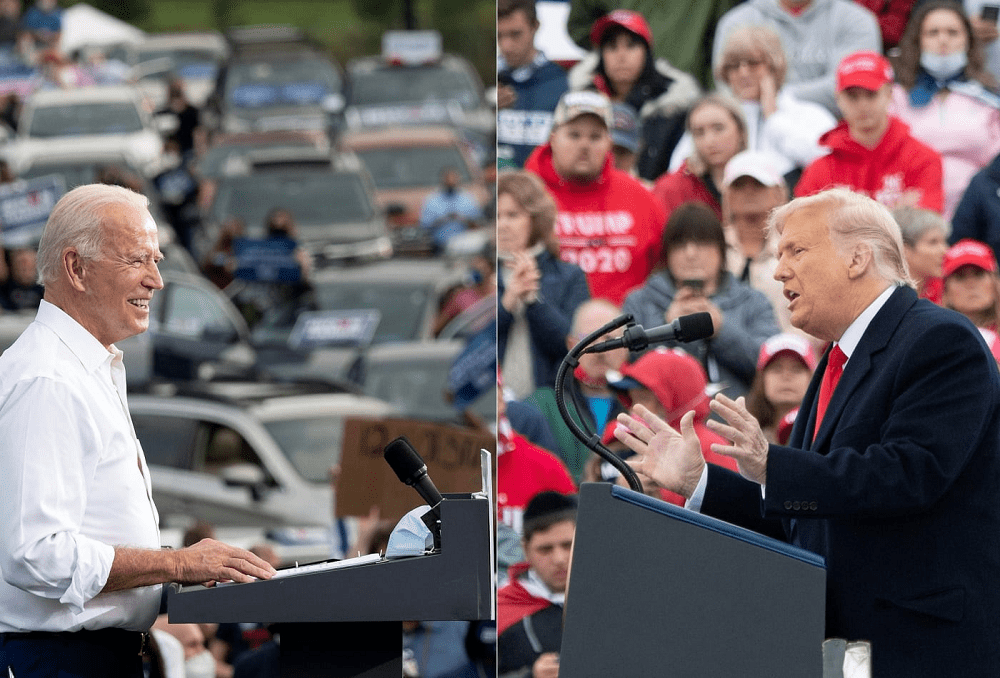

Trump hinted at a campaign rally in Reading, PA on Saturday that he intends to use the Supreme Court, which now has a 6-3 conservative lean, to secure the election if he is unable to do so at the ballot box. Such a move would very likely have a destabilizing effect on markets and lead to widespread civil unrest.

Part of the reason markets are seeking a certain outcome in either direction is to solidify hopes for a new coronavirus aid package, which would suffer further delays in the event of a contested election at a time when Covid-19 cases are spiking across the country.

Most polls have Biden ahead in both the national vote and a majority of key swing states a Democratic sweep of the White House, Senate and House of Representatives may be seen as more beneficial to Europe.

An increase in the corporate tax rate from 21% to 28% under a Biden administration would be more negative for U.S. than European equities, according to Barclays, but European companies with exposure to the U.S. that benefited from Trump’s 2017 tax cuts may see a slight hit to their earnings per share.

The Democrats’ $2 billion spending plan to help shore up the economy from the fallout of the pandemic is considerably larger and markedly different in content to that of their Republican counterparts.

European markets brace for a U.S. election unlike any other, CNBC, Nov 3