Market watchers believe the European Central Bank (ECB) could fine-tune its policies this week, and may even follow the Federal Reserve by revising its inflation targets in the longer term. The ECB’s Governing Council convenes on Wednesday and Thursday to discuss its monetary policy stance and its assessment of the euro zone economy. Since its last meeting, economic data has shown signs of a slowing of the recovery, the euro has appreciated and core inflation slumped to a new record low in August.

While the majority of analysts don’t expect much policy action and think the ECB will wait until December, there is a remote chance of tweaks to its guidance this week, backed by new staff projections. The single currency has appreciated considerably since its March lows making euro zone goods more expensive for the rest of the world and dampening price pressure from imported goods.

To make things more complicated for the Frankfurt-based ECB, the Federal Reserve’s recent policy shift toward an average inflation target means lower interest rates for longer in the U.S. and more pressure on the dollar. The ECB thinks highly analytically about current situations and future policy. Its chief economist, Philip Lane, hinted at a two-staged response at his Jackson Hole speech in August, suggesting the central bank’s crisis toolkit may not be enough to address persistently low inflation.

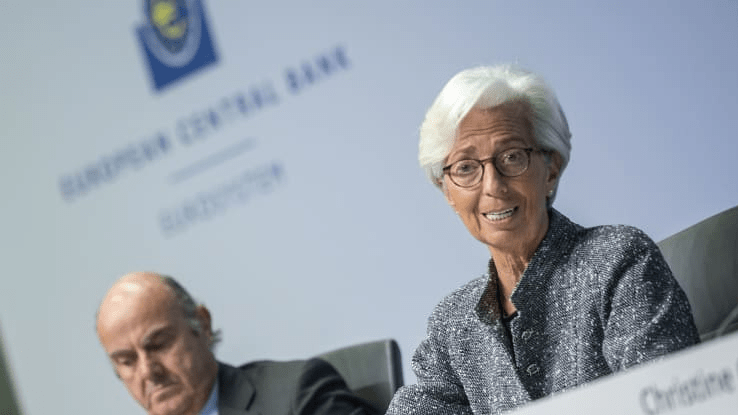

European Central Bank could announce policy tweaks after shock inflation data, CNBC, Sep 10