European stocks climbed with global peers on optimism over economies reopening in some parts of the world and hopes for a vaccine to fight the coronavirus. The Stoxx Europe 600 Index added 1.2% as of 8:19 a.m. in London, rising to its highest level since March. Travel and leisure shares led a broad advance in industry groups, with only health-care shares in the red. The FTSE 100 Index rallied 1.8% as the U.K. market reopened after a holiday yesterday.

European stocks are advancing for a second day, tracking Asian markets higher after Japan ended its state of emergency everywhere in the country, while Britain’s government outlined plans to reopen outdoor markets and car showrooms starting June, followed by non-essential outlets later in the month. Adding to investor optimism, Novavax Inc. began human testing of its coronavirus vaccine candidate.

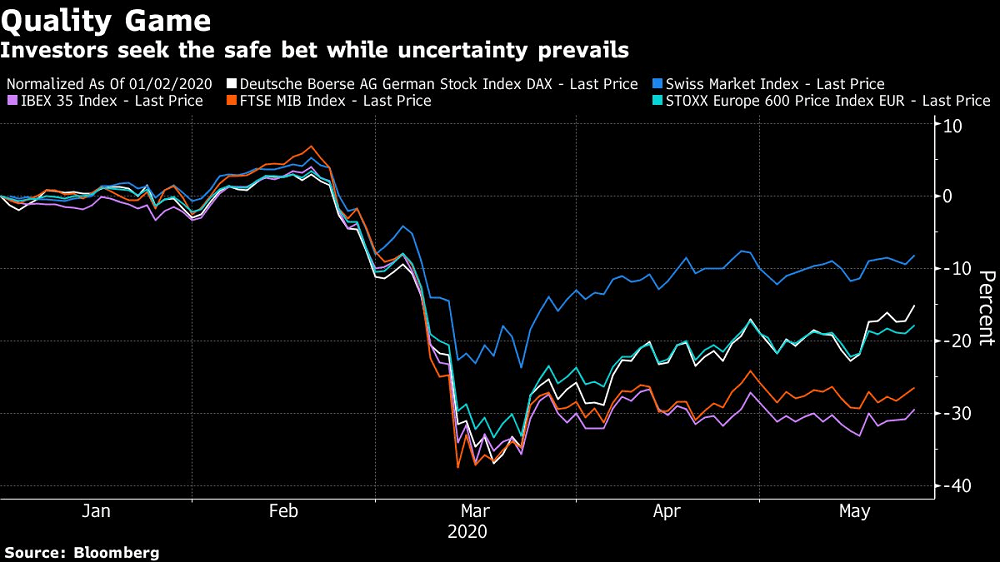

Although a rally since a March low lost steam this month amid bleak economic and corporate updates, and tension over U.S.-China ties, investors have focused on easing lockdowns and vaccine hopes, preferring to view the glass as half full. The Stoxx 600 is on track for a gain of 2.6% in May.

“While the V-shaped economic recovery remains a pipe dream for now, investors don’t mind and push stocks higher for several reasons,” said Frederik Hildner, portfolio manager Salm-Salm & Partner by phone. “What’s in demand is mostly technology and rock solid balance sheets. These offer long-term growth prospects and protection against potentially higher inflation in the aftermath of massive quantitative easing.”

Europe Stocks Climb to 11-Week High on Optimism Over Reopening, Bloomberg, May 26