In Jackson Hole last week, the Fed chairman said that a weak labour market would slow down inflation, which is rising due to tariffs. The central bank could now throw the US economy a lifeline in the form of monetary policy easing. This news allowed EURUSD to soar above 1.17 on Friday.

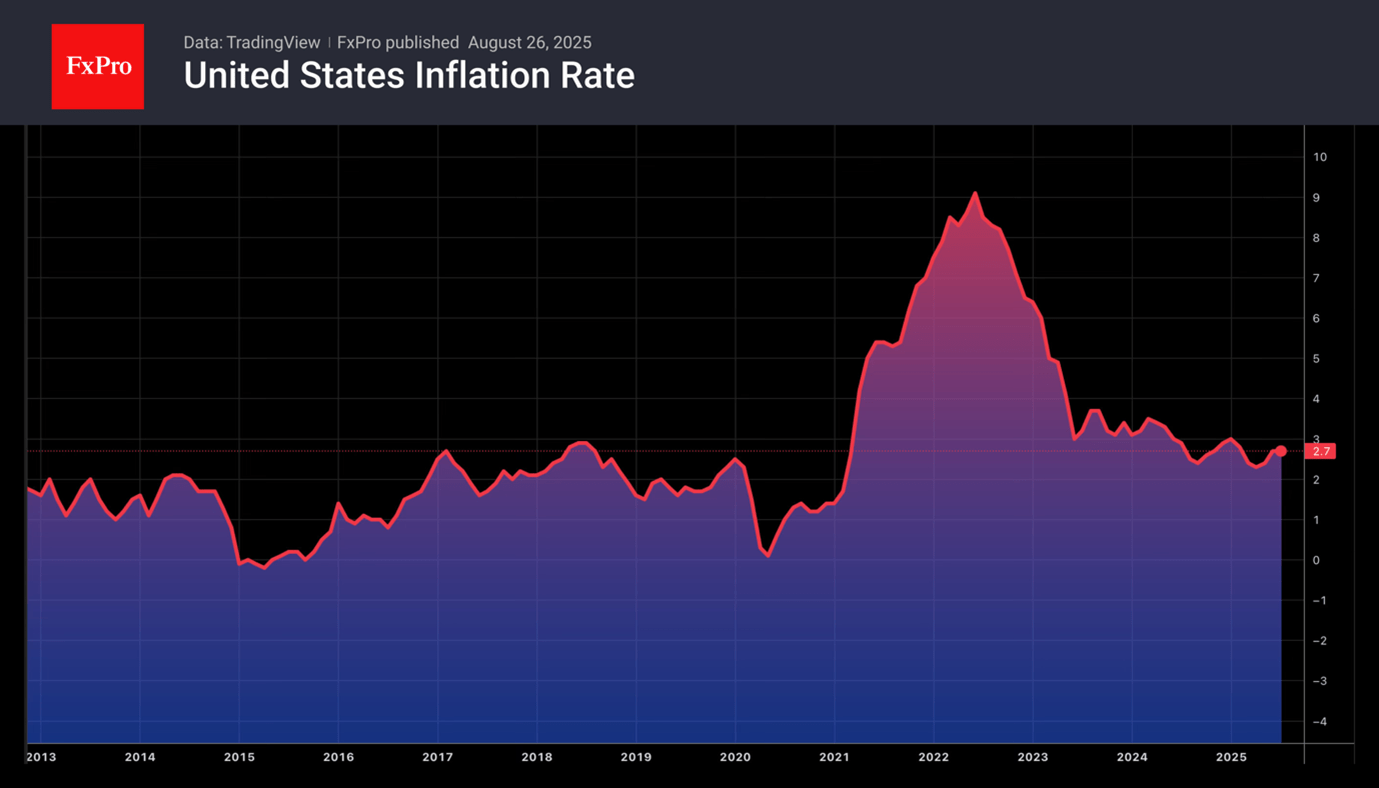

However, history shows that the Fed is sometimes wrong. In 2021 to 2022, it also discussed transitory inflation and delayed the start of the monetary tightening cycle. What if high prices are here to stay in the US economy? The market began to doubt the veracity of Jerome Powell’s speech, bringing the Euro-Dollar pair back down to earth.

In fact, due to Donald Trump’s policies, the United States risks facing negative net immigration in 2025. As a result, according to Apollo research, non-farm employment would grow by an average of 24,000 per month. In 2015-2024, the figure increased by 155,000. The Fed will have to cut rates, but at the same time, the ECB will keep them unchanged if the eurozone economy accelerates due to Germany’s fiscal stimulus.

The divergence in monetary policy among the world’s leading central banks paints a bullish outlook for EURUSD. The uptrend will remain in place, and pullbacks will be actively bought, especially since Donald Trump’s attacks on the Fed are undermining confidence not only in the US central bank but also in the US dollar.

The US president has announced the dismissal of FOMC member Lisa Cook. If she is unable to defend herself in court, the Fed’s independence will be threatened, and the central bank will become a puppet of the White House. Aggressive rate cuts will fuel inflation. In such conditions, it will become extremely dangerous to keep your money in the United States, since capital outflows will put downward pressure on the US dollar.

Technically, a return of EURUSD above its fair value of 1.165 and resistance at 1.169 will open the way for the main currency pair to resume its upward trend.

The FxPro Analyst Team