The single currency has been one of the losers from Trump’s victory, losing 2% on Wednesday to 1.07, its lowest since July. And it’s not just a story of a strong dollar, with the euro also losing around 0.7% against the Swiss franc and 0.8% against the pound.

The single currency’s weakness has been attributed to fears of trade wars, which made life noticeably more difficult for Europe during Trump’s last presidency. Then, as now, it could be a double whammy: immediate tariffs on European goods and increased pressure on China, reducing demand in the Middle Kingdom and squeezing German exports there.

While the short-term market reaction may seem overly impulsive, this could be far from the final leg down. EURUSD fell 15% from the start of 2018 to the lows of 2020. The euro’s weakness then kept pace with the decline in German industrial production. Production has fallen since the beginning of last year, even without a trade war with the US, but opening a new front could accelerate the process.

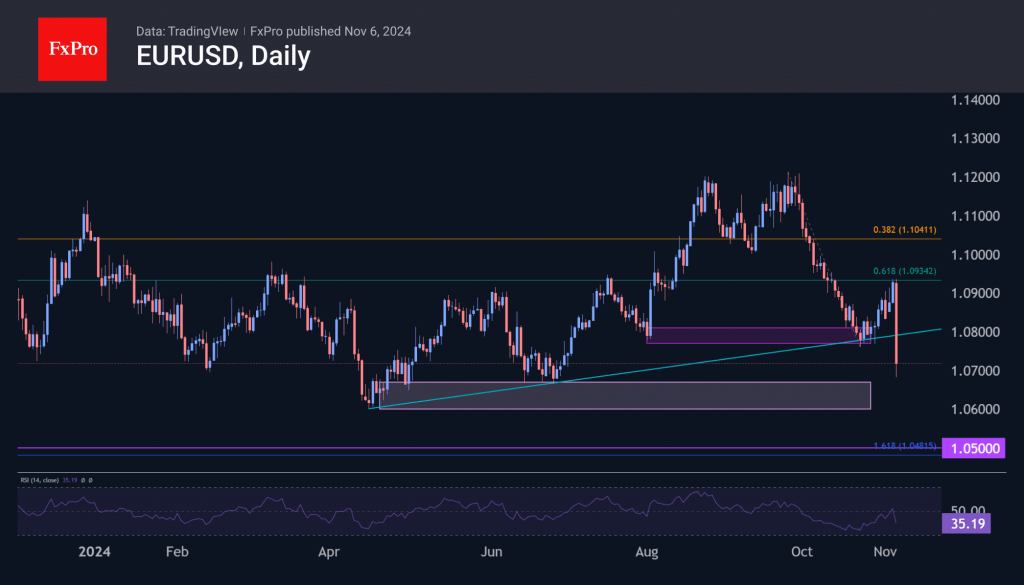

The outlook for the EURUSD is much the same. The pair approached 1.20 in late September but has pulled back to 1.07, testing the range support of the past 12 months.

Technically, the EURUSD’s failure to break below 1.0770 confirmed the market’s strong bearish bias following last week’s corrective pullback. According to Fibonacci’s theory, the pair has downside potential in the 1.05 area, which is near the 161.8% level of the monthly decline from the September peak.

However, even earlier, in the 1.0600-1.0670 area, the euro could find strong support and retreat to the year’s lows.

From a fundamental point of view, pressure on the single currency is increasing due to fears of a further narrowing of the trade surplus and the need for the ECB to stimulate the economy more actively.

At the same time, it is too early to talk about the dollar breaking parity with the euro. Only a sustained decline below 1.05 will open the way to 0.95 or even 0.85. But we have seen how tenaciously this level has been defended over the past 10 years, and it was only broken for a few months in 2022 amid a series of shocks ranging from lockdowns and logistical problems to energy prices and supply issues.

The FxPro Analyst Team