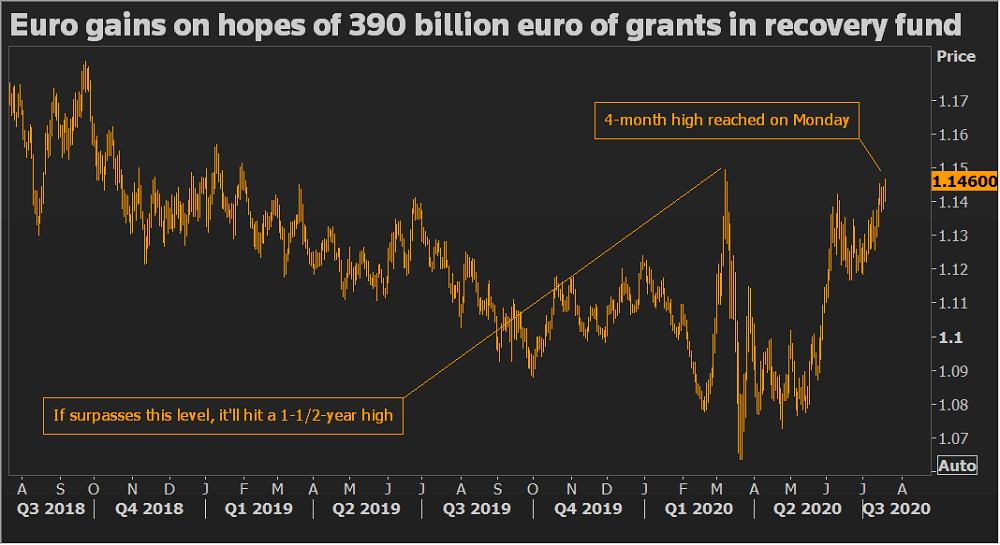

The euro climbed to its highest in more than four months against the U.S. dollar on Monday on hopes that the European Union would agree on a recovery fund for economies in the region hit by the COVID-19 pandemic. The fund is expected to be around 750 billion euros ($857.93 billion), of which 390 billion euros could be offered as grants.

European Union leaders said they were cautiously optimistic that agreement on a massive stimulus plan for their coronavirus-blighted economies was within reach, though tensions among them remained high after days of squabbling.

“We can’t help but notice how bullish the street is when it comes to euro/dollar forecasts, and so we have to wonder if the eventual confirmed deal headlines prompt a ‘buy the rumor/sell the fact’ type of market reaction,” said Erik Bregar, head of FX strategy at Exchange Bank of Canada in Toronto.

Positive news about a potential COVID-19 vaccine also added to overall market optimism, lifting currencies that thrive in times of increased risk appetite, such as the Australian and New Zealand dollars.

In midday trading, the euro was last up 0.1% at $1.1442, after earlier hitting a more than four-month high of $1.1467. Analysts said the smaller the amount of grants from the EU fund, the more the euro would fall. If EU leaders agree on a recovery fund, that would boost confidence in the euro regardless of the numbers in the deal, said Mike Bell, global market strategist at J.P. Morgan Asset Management.

The dollar rose 0.2% versus the yen to 107.25 and was up 0.1% against the Swiss franc to 0.9396 franc. The Australian and New Zealand dollars, however, gained against the greenback to US$0.7004 and US$0.6562.

Euro climbs to more than four-month peak on EU recovery fund optimism, Reuters, Jul 20