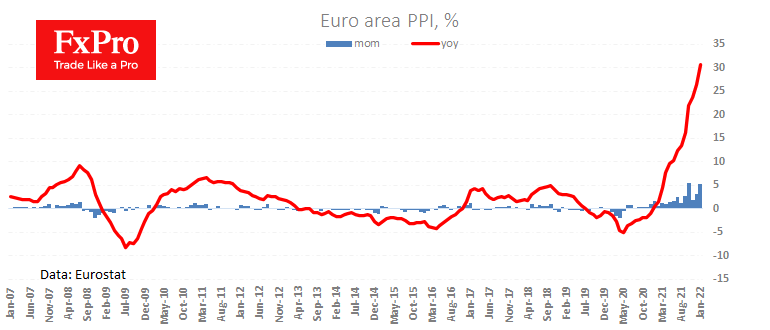

Euro area producer prices accelerated their rise in January – a significant early signal of a further increase in consumer inflation. A fresh Eurostat report showed that PPI rose by 5.2% in the first month of the year, twice as much as expected and by 30.6% to the same month a year earlier.

Until the middle of last year, the year-over-year growth rate had not exceeded 10% in the indicator’s 40-year history. However, the combination of a low base and subsequent supply-chain disruptions for some commodities and energy are feeding this wave.

The latest spike in gas prices and Brent’s jump by a third since the start of February indicates that price pressure promises to remain extremely high next month.

A couple of months ago, this would have been good news for the euro, as markets would have reinforced expectations of policy tightening. Now the figures point to a looming inflationary horror in the eurozone, which the ECB is unlikely to tackle in order not to multiply the region’s economic shock.

The FxPro Analyst Team