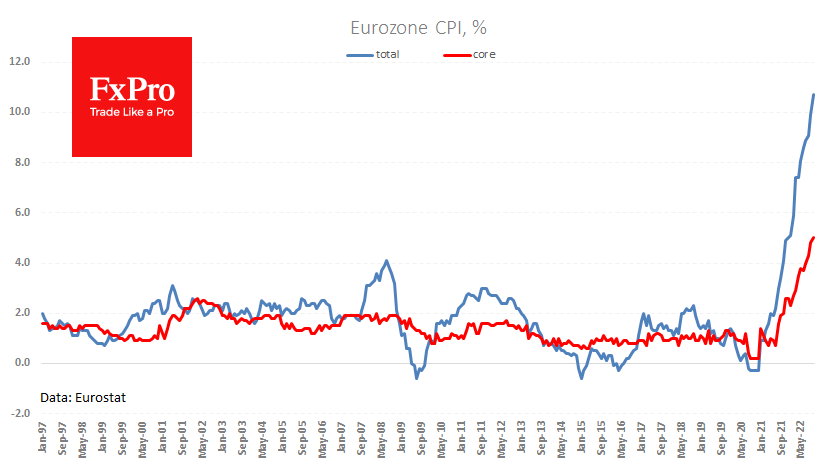

Eurostat’s preliminary estimate indicated an acceleration of annual inflation in the euro region from 9.9% immediately to 10.7%. Economists, on average, expected no change, and this difference of 0.8 percentage points is one of the most prominent indicators economists predict quite accurately on average.

But it’s not only this surprise that we want to point out, but also how fast price growth has spread beyond energy and food categories. Core inflation accelerated to 5% YoY in September, adding 0.6% MoM. Non-energy industrial goods rose at 1.2% MoM and 6.0% YoY.

These dynamics should signal that the ECB should not reduce the pace of monetary tightening. No doubt the ECB had this or very comparable data available for last Thursday’s meeting but chose to act within market expectations with a rate hike of 75 points.

A softer policy than required by the macroeconomic context is likely to be one of the reasons for the pressure on the euro on Monday. The EURUSD is testing the 0.9900 level and the 50-day moving average from above. A sharp dip below would make the previous breakout be considered false. A breakup of the rising trend from the end of September would set the pair to create a global low, disappointing the recent buyers.

At the same time, the market is unlikely to make an essential move beyond local trends before the results of Wednesday evening’s Fed meeting. The FOMC is expected to raise rates by 75 points for the fourth consecutive time but will indicate a smaller rate hike in the future, which could reduce traction in dollar-denominated assets.

The FxPro Analyst Team