Preliminary PMI estimates for the entire eurozone exceeded expectations, but this did not help the single currency grow. On Tuesday, the rise to 1.18 was actively sold off.

French businesses reacted negatively to the political turmoil caused by budget disputes, which also affected tariffs. Both the service sector and manufacturing performed below expectations and showed a deepening decline. The composite index fell to 48.4, its lowest level since April.

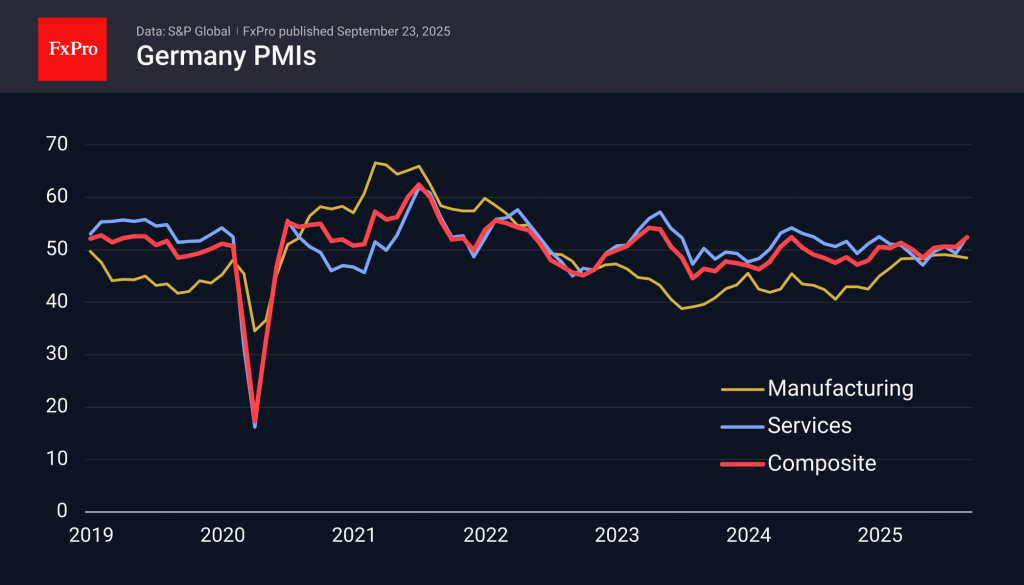

The main positive surprise came from the German services sector, where the index jumped from 49.3 to 52.8 against the expected 49.5. This is the highest the index has been since May 2024. These figures signal a return to service growth, while market participants had expected the downturn to continue, with values below 50.

However, Germany’s manufacturing sector contributes much more than in the UK or the US, so the unexpectedly sharp drop in the manufacturing PMI from 48.8 to 48.5, against an expected rise to 50.1, is dampening optimism.

Germany pulled up the service sector figures for the entire eurozone, ensuring that the index rose to its highest level since December. The composite index reached 51.2, its highest level since May last year.

Higher-than-expected figures for the eurozone are allowing the euro to remain at a relatively high level of $1.1800 and are pushing EURGBP to the upper limit of its range for almost two years. However, these improvements are too modest to become the basis for a breakthrough of important resistance levels, which the euro has been unable to overcome for the past two months.

The FxPro Analyst Team