The 27 European Union governments have reached a breakthrough agreement over new fiscal stimulus, following marathon talks in Brussels that lasted four days. The European Commission, the executive arm of the EU, has been tasked with tapping financial markets to raise an unprecedented 750 billion euros ($857 billion). The funds will be distributed among the countries and sectors most impacted by the coronavirus pandemic, and will take the form of grants and loans.

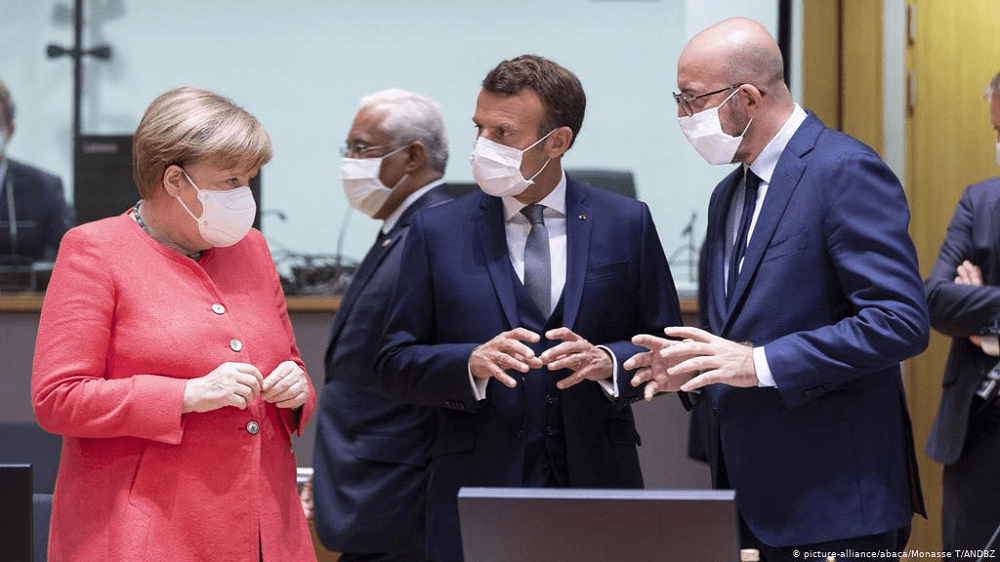

European Council President Charles Michel said early Tuesday that he believes this deal will be seen as a “pivotal moment” for Europe.The heads of state had been locked in talks since Friday morning to discuss the proposed fund and the EU’s next budget. However, deep differences on how to divide the amount between grants and loans, how to oversee its investment and how to link it with the EU’s democratic values prolonged the talks into one of the longest EU summits in history.

In the end, they agreed to distribute 390 billion euros, out of the total 750 billion fund, in the form of grants — a significant reduction from an initial proposal made by France and Germany in May for 500 billion euros of grants. The EU also agreed that net debt issuance will end in 2026 and that they will repay all the new debt by 2058.

In the meantime, member states will also have to develop plans outlining how they will invest the new funds. These so-called Reform and Recovery plans will have to be approved by their European counterparts, by qualified majority — rather than by unanimity as had been insisted upon by the Netherlands at one point.

In addition to the recovery fund, the EU said its next budget, which will fund initiatives between 2021 and 2027, will total 1.074 trillion euros. The two combined bring upcoming investments to the level of 1.824 trillion euros.

The recovery fund will be available from January 2021 and there will be no new bridge financing until then. This is because the EU has taken other measures since the crisis struck to provide liquidity to the member states if they are needed.

European governments will have to find new financial resources to repay some of the additional debt, and this includes new taxes. The deal states that there should be a non-recycled plastic waste levy introduced as of Jan. 1, 2021, and that a carbon border adjustment mechanism and a digital duty should be in place by Jan. 1, 2023. The latter represents almost a two-year delay from what an earlier proposal suggested in terms of digital taxation.

EU leaders reach $2 trillion deal on recovery plan after marathon summit, CNBC, Jul 21