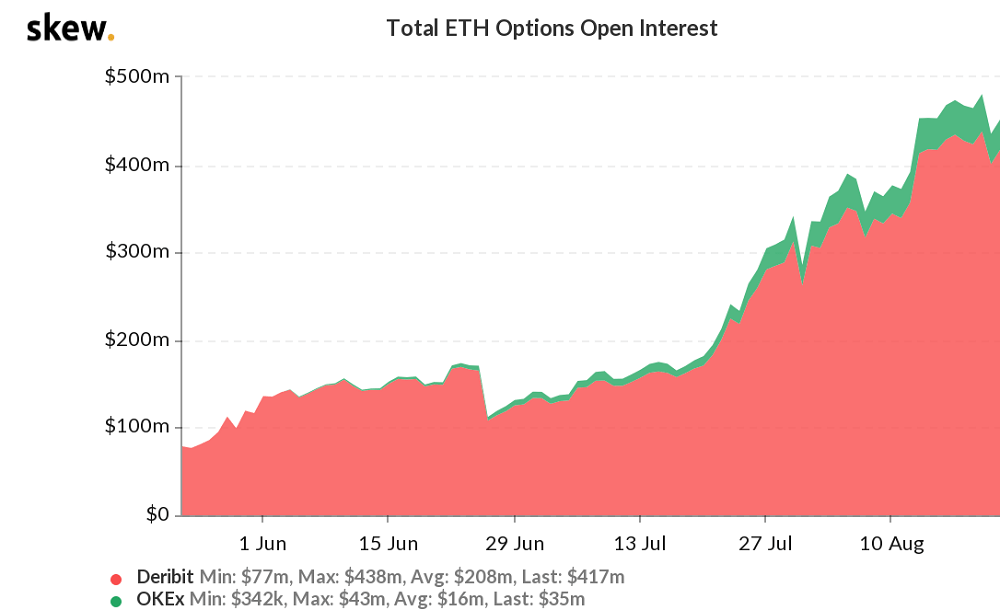

$112 million in Ethereum options expire on August 28 but data shows traders remain bullish even as ETH trades below $400. Ether (ETH) options contracts have grown five-fold in the past three months to currently sit at $452 million. The $112 million set to expire this Friday could have a considerable market impact, although that will depend on the balance between bullish and bearish strategies.

The above chart shows just how strong the ETH options market has been in the past month. Although its open interest might seem modest compared to Bitcoin’s (BTC) $1.9 billion options market, ETH options have become more relevant over the past couple of months. Not every options market strategy is bullish or bearish. The covered call consists of buying the underlying asset while selling a call (buy) option.

Even though open interest for options below the $320 strike is considerable, it could have been built over a month ago while ETH traded below $250.

There are currently 97,000 Ether options with a $400 strike, although this includes all calendar expiries until March 2021. By analyzing the upcoming August 28 expiry exclusively, a trader would have a better gauge of investors’ true sentiment.

There are currently 27,800 call options, stacked against 31,400 put options at the $380 to $400 range. This means that, at least for the August expiry, there seems to be an even force between bullish and bearish options strategies.

The 25% delta skew indicator measures how much more expensive (or cheaper) a call option is relative to a similar put option. A negative skew indicates that the cost of protection for bullish movements is more costly than for downside price swings.

Ether derivatives remain bullish

Short-term price movements easily stress out many traders, and behavioral economics studies have proven that the mental impacts of losses vastly exceed those of winnings.

The recent 9% drop from $440 should be deemed insignificant after a 200% rally in the past five months.

Ethereum price lingers at key resistance days before $112M options expiry, CoinTelegraph, Aug 25